MACP SCHEME FOR THE CENTRAL GOVERNMENT CIVILIAN EMPLOYEES ORIGINAL ORDER DATED MAY 2009

IMMEDIATE

No.35034/3/2008-Estt. (D)

Government of India

Ministry of Personnel, Public Grievances and Pensions

(Department of Personnel and Training)

North Block, New Delhi, the 19th May, 2009

OFFICE MEMORANDUM

SUBJECT:

MODIFIED ASSURED CAREER PROGRESSION SCHEME (MACPS) FOR THE CENTRAL GOVERNMENT CIVILIAN EMPLOYEES

The Sixth Central Pay Commission (

6CPC)

in Para 6.1.15 of its report, has recommended Modified Assured Career

Progression Scheme (MACPS). As per the recommendations, financial

upgradation will be available in the next higher grade pay whenever an

employee has completed 12 years continuous service in the same grade.

However, not more than two financial upgradations shall be given in the

entire career, as was provided in the previous Scheme. The Scheme will

also be available to all posts belonging to Group "A" whether isolated

or not. However, organised Group "A" services will not be covered under

the Scheme

2. The Government has considered the

recommendations of the Sixth Central Pay Commission for introduction of a

MACPS and has accepted the same with further modification to grant

three financial upgradations under the MACPS at intervals of 10, 20 and

30 years of continuous regular service.

3. The Scheme would be known as

"MODIFIED ASSURED CAREER PROGRESSION. SCHEME (MACPS) FOR THE CENTRAL GOVERNMENT CIVILIAN EMPLOYEES.

This Scheme is in supersession of previous ACP Scheme and

clarifications issued there under and shall be applicable to all

regularly appointed Group "A", "B", and "C"

Central Government Civilian Employees except officers of the Organised Group "A" Service.

The status of Group "0" employees would cease on their completion of

prescribed training, as recommended by the Sixth Central Pay Commission

and would be treated as Group "C" employees. Casual employees, including

those granted 'temporary status' and employees appointed in the

Government only on adhoc or contract basis shall not qualify for

benefits under the aforesaid Scheme. The details of the MACP Scheme and

conditions for grant of the financial upgradation under the Scheme are

given in Annexure-I.

4. An Screening Committee shall be

constituted in each Department to consider the case for grant of

financial upgradations under the MACP Scheme. The Screening Committee

shall consist of a

Chairperson and two members. The members of

the Committee shall comprise officers holding posts which are at least

one level above the grade in which the MACP is to be considered and not

below the rank of Under Secretary equivalent in the Government. The

Chairperson should generally be a grade above the members of the

Committee.

5. The recommendations of the Screening

Committee shall be placed before the Secretary in cases where the

Committee is constituted in the Ministry / Department or before the

Head of the organisation / competent authority in other cases for

approval.

6. In order to prevent undue strain on the administrative machinery, the Screening Committee shall follow a

time-schedule and meet twice in a financial year - preferably in the first week of

January and first week of

July of a year for

advance

processing of the cases maturing in that half. Accordingly, cases

maturing during the first-half (April - September) of a particular

financial year shall be taken up for consideration by the screening

Committee meeting in the first week of January. Similarly, the Screening

Committee meeting in the first week of July of any financial year shall

process the cases that would be maturing during the second-half

(October - March) of the same financial year.

7.

However, to make the MACP Scheme operational, the Cadre Controlling

Authorities shall constitute the first Screening Committee within a

month from the date of issue of these instructions to consider the cases

maturing upto 30th June, 2009 for grant of benefits under the MACPS.

8.

In so far as persons serving in The Indian Audit and Accounts

Departments are concerned, these orders issue after consultation with

the Comptroller and Auditor General of India.

9. Any

interpretation / clarification of doubt as to the scope and meaning of

the provisions of the MACP Scheme shall be given by the Department of

Personnel and Training (Establishment-D). The scheme would be

operational

w.e.f. 01.09.2008. In other words, financial

upgradations as per the provisions of the earlier ACP Scheme (of August,

1999) would be granted till 31.08.2008.

10. No

stepping up of pay in the pay band or grade pay would be admissible with

regard to junior getting more pay than the senior on account of pay

fixation under MACP Scheme.

11. It is clarified that no

past cases would be re-opened. Further, while implementing the MACP

Scheme, the differences in pay scales on account of grant of financial

upgradation under the old ACP Scheme (of August 1999) and under the MACP

Scheme within the same cadre shall not be construed as an anomaly.

12. Hindi version will follow.

(S.Jainendra Kumar)

Deputy Secretary to the Govt. Of India

ANNEXURE-I

MODIFIED ASSURED CAREER PROGRESSION SCHEME (MACPS)

1. There shall

be three financial upgradation s under the MACPS, counted from the

direct entry grade on completion of 10, 20 and 30 years service

respectively. Financial upgradation under the Scheme will be admissible

whenever a person has spent 10 years continuously in the same grade-pay.

2.

The MACPS envisages merely placement in the immediate next higher grade

pay in the hierarchy of the recommended revised pay bands and grade pay

as given in Section 1 , Part-A of the first schedule of the CCS

(Revised Pay) Rules, 2008. Thus, the grade pay at the time of financial

upgradation under the MACPS can, in certain cases where regular

promotion is not between two successive grades, be different than what

is available at the time of regular promotion. In such cases, the higher

grade pay attached to the next promotion post in the hierarchy of the

concerned cadre/ organisation will be given only at the time of regular

promotion.

3. The financial upgradation s under the MACPS would be admissible up-to the highest grade pay of Rs. 12000/- in the PB-4.

4.

Benefit of pay fixation available at the time of regular promotion

shall also be allowed at the time of financial upgradation under the

Scheme. Therefore, the pay shall be raised by 3% of the total pay in the

pay band and the grade pay drawn before such upgradation. There shall,

however, be no further fixation of pay at the time of regular promotion

if it is in the same grade pay as granted under MACPS. However, at the

time of actual promotion if it happens to be in a post carrying higher

grade pay than what is available under MACPS, no pay fixation would be

available and only difference of grade pay would be made available.

To

illustrate, in case a Government Servant joins as a direct recruit in

the grade pay of Rs. 1900 in PB-1 and he gets no promotion till

completion of 10 years of service, he will be granted financial

upgradation under MACPS in the next higher grade pay of Rs. 2000 and his

pay will be fixed by granting him one increment plus the difference of

grade pay (i.e. Rs. 100). After availing financial upgradation under

MACPS, if the Government servant gets his regular promotion in the

hierarchy of his cadre, which is to the grade of Rs. 2400, on regular

promotion, he will only be granted the difference of grade pay between

Rs. 2000 and Rs. 2400. No additional increment win be granted at this

stage.

5. Promotions earned / upgradations granted

under the ACP Scheme in the past to those grades which now carry the

same grade pay due to merger of pay scales / upgradations of posts

recommended by the Sixth Pay Commission shall be ignored for the purpose

of granting upgradations under Modified ACPS.

Illustration-1

The pre-revised hierarchy (in ascending order) in a particular organization was as under:-

- A Government servant who was recruited in the hierarchy in the

pre-revised pay scale Rs. 5000-8000 and who did not get a promotion even

after 25 years of service prior to 1.1.2006,in his case as on

1.1.2006he would have got two financial upgradations under ACP to the

next grades in the hierarchy of his organization, i.e., to the

pre-revised scales of Rs. 5500-9000 and Rs. 6500-10500.

- Another Government servant recruited in the same hierarchy in the

pre-revised scale of Rs. 5000-8000 has also completed about 25 years of

service, but he got two promotions to the next higher grades of Rs.

5500-9000 & Rs. 6500-10500 during this period.

In the case of both (a) and (b) above, the promotions /

financial upgradations granted under ACP to the pre-revised scales of

Rs. 5500-9000 and Rs. 6500-10500 prior to 1.1.2006will be ignored on

account of merger of the pre-revised scales of Rs. 5000- 8000, Rs.

5500-9000 and Rs. 6500-10500 recommended by the Sixth cpe. As per CCS

(RP) Rules, both of them will be granted grade pay of Rs. 4200 in the

pay band PB-2. After the implementation of MACPS, two financial

upgradations will be granted both in the case of (a) and (b) above to

the next higher grade pays of Rs. 4600 and Rs. 4800 in the pay band

PB-2.

6. In the case of all the employees granted

financial upgradations under ACPS till 01.01.2006, their revised pay

will be fixed with reference to the pay scale granted to them under the

ACPS.

6.1 In the case of ACP upgradations granted

between 01.01.2006 and 31.08.2008, the Government servant has the option

under the CCS (RP) Rules, 2008 to have his pay fixed in the revised pay

structure either (a) w.eJ. 01.01.2006 with reference to his pre-revised

scale as on 01.01.2006; or (b) w.e.f. the date of his financial

upgradation under ACP with reference to the pre-revised scale granted

under ACP. ln case of option (b), he shall be entitled to draw his

arrears of pay only from the date of his option i.e. the date of

financial upgradation under ACP.

6.2 In cases where

financial upgradation had been granted to Government servants in the

next higher scale in the hierarchy of their cadre as per the provisions

of the ACP Scheme of August, 1999, but whereas as a result of the

implementation of Sixth CPC's recommendations, the next higher post in

the hierarchy of the cadre has been upgraded by granting a higher grade

pay, the pay of such employees in the revised pay structure will be

fixed with reference to the higher grade pay granted to the post. To

illustrate, in the case of Jr. Engineer in CPWD, who was granted ]"t ACP

in his hierarchy to the grade of Asstt. Engineer in the pre-revised

scale of Rs.6500-10500 corresponding to the revised grade pay of Rs.4200

in the pay band PB-2, he win now be granted grade pay of Rs4600 in the

pay band PB-2 consequent upon upgradation of the post of Asstt. Enggs.In

CPWD by granting them the grade pay of Rs.4600 in PB-2 as a result of

Sixth CPC's recommendation. However, from the date of implementation of

the MACPS, all the financial upgradations under the Scheme should be

done strictly in accordance with the hierarchy of grade pays in pay

bands as notified vide CCS (Revised Pay) Rules, 2008.

7.

With regard to fixation of his pay on grant of promotion / financial

upgradation under MACP Scheme, a Government servant has an option under

FR22 (1) (a) (1) to get his pay fixed in the higher post/ grade pay

either from the date of his promotion/upgradation or from the date of

his next increment viz. 1st July of the year. The pay and the date of

increment would be flxed in accordance with clarification no.2 of

Department of Expenditure's O.M. No.1/1/2008-1C dated 13.09.2008.

8.

Promotions earned in the post carrying same grade pay in the

promotional hierarchy as per Recruitment Rules shall be counted for the

purpose of MACPS.

8.1 Consequent upon the

implementation of Sixth CPe's recommendations, grade pay of Rs. 5400 is

now in two pay bands viz., PB-2 and PB-3. The grade pay of Rs. 5400 in

PB-2 and Rs.5400 in PB-3 shall be treated as separate grade pays for the

purpose of grant of upgradations under MACP Scheme.

9.

'Regular service'

for the purposes of the MACPS shall commence from the date of joining

of a post in direct entry grade on a regular basis either on direct

recruitment basis or on absorption/re-employment basis. Service rendered

on adhoc/contract basis before regular appointment on pre-appointment

training shall not be taken into reckoning. However, past continuous

regular service in another Government Department in a post carrying same

grade pay prior to regular appointment in a new Department, without a

break, shall also be counted towards qualifying regular service for the

purposes of MACPS only (and not for the regular promotions). However,

benefits under the MACPS in such cases shall not be considered till the

satisfactory completion of the probation period in the new post.

10.

Past service

rendered by a Government employee in a State Government / statutory

body / Autonomous body / Public Sector organisation, before appointment

in the Government shall not be counted towards Regular Service.

Also check

7th CPC MACP FOR THE CENTRAL GOVERNMENT CIVILIAN EMPLOYEES – DOPT CONSOLIDATED GUIDELINES

11.

'Regular service'

shall include all periods spent on deputation/foreign service, study

leave and all other kind of leave, duly sanctioned by the competent

authority.

12. The MACPS shall also be applicable to

work charged employees, if their service conditions are comparable with

the staff' of regular establishment.

13. Existing

time-bound promotion scheme, including in-situ promotion scheme, Staff

Car Driver Scheme or any other kind of promotion scheme existing for a

particular category of employees in a Ministry / Department or its

offices, may continue to be operational for the concerned category of

employees if it is decided by the concerned administrative authorities

to retain such Schemes, after necessary consultations or they may

switch-over to the MACPS. However, these Schemes shall not run

concurrently with the MACPS.

14. The MACPS is directly

applicable only to Central Government Civilian employees. It will not

get automatically extended to employees of Central Autonomous /

Statutory Bodies under the administrative control of a Ministry /

Department. Keeping in view the financial implications involved, a

conscious decision in this regard shall have to be taken by the

respective Governing Body/Board of Directors and the administrative

Ministry concerned and where it is proposed to adopt the MACPS, prior

concurrence of Ministry of Finance shall be obtained.

15.

If a financial upgradations under the MACPS is deferred and not allowed

after 10 years in a grade pay, due to the reason of the employees being

unfit or due to departmental proceedings, etc., this would have

consequential effect on the subsequent financial upgradation which would

also get deferred to the extent of delay in grant of first financial

upgradation.

16. On grant of financial upgradation

under the Scheme, there shall be no change in the designation,

classification or higher status. However, financial and certain other

benefits which are linked to the pay drawn by an employee such as HBA,

allotment of Government accommodation shall be permitted.

17.

The financial upgradation would be on non-functional basis subject to

fitness, in the hierarchy of grade pay within the PB-1.Thereafter for

upgradation under the MACPS the benchmark of 'good' would be applicable

till the grade pay of Rs. 6600/- in PB-3. The benchmark will be 'Very

Good' for financial upgradation to the grade pay of Rs.7600 and above.

18.

In the matter of disciplinary/ penalty proceedings, grant of benefit

under the MACPS shall be subject to rules governing normal promotion.

Such cases shall, therefore, be regulated under the provisions of the

CCS (CCA) Rules, 1965 and instructions issued thereunder.

19.

The MACPS contemplates merely placement on personal basis in the

immediate higher Grade pay /grant of financial benefits only and shall

not amount to actuallfunctional promotion of the employees concerned.

Therefore, no reservation orders/roster shall apply to the MACPS, which

shall extend its benefits uniformly to all eligible SC/ST employees

also. However, the rules of reservation in promotion shall be ensured at

the time of regular promotion. For this reason, it shall not be

mandatory to associate members of SC/ST in the Screening Committee meant

to consider cases for grant of financial upgradation under the Scheme.

20.

Financial upgradation under the MACPS shall be purely personal to the

employee and shall have no relevance to his seniority position. As such,

there shall be no additional financial upgradation for the senior

employees on the ground that the junior employee in the grade has got

higher pay/grade pay under the MACPS.

21. Pay drawn in

the pay band and the grade pay allowed under the MACPS shall be taken as

the basis for determining the terminal benefits in respect of the

retiring employee.

22. If Group "A" Government

employee, who was not covered under the ACP Scheme has now become

entitled to say third financial upgradation directly, having completed

30 year's regular service, his pay shall be fixed successively in next

three immediate higher grade pays in the hierarchy of revised pay-bands

and grade pays allowing the benefit of 3% pay fixation at every stage.

Pay of persons becoming eligible for second financial upgradation may

also be fixed accordingly.

23. In case an employee is

declared surplus in his / her organisation and appointed in the same

pay-scale or lower scale of pay in the new organization, the regular

service rendered by him/her in the previous organisation shall be

counted towards the regular service in his/her new organisation for the

purpose of giving nnancial upgradation under the MACPS.

24.

In case of an employee after getting promotion/ACP seeks unilateral

transfer on a lower post or lower scale, he will be entitled only for

second and third nnancial upgradations on completion of 20/30 years of

regular service under the MACPS, as the case may be, from the date of

his initial appointment to the post in the new organization.

25.

If a regular promotion has been offered but was refused by the employee

before becoming entitled to a financial upgradation, no financial

upgradation shall be allowed as such an employee has not been stagnated

due to lack of opportunities. If, however, financial upgradation has

been allowed due to stagnation and the employees subsequently refuse the

promotion, it shall not be a ground to withdraw the financial

upgradation. He shall, however, not be eligible to be considered for

further financial upgradation till he agrees to be considered for

promotion again and the second the next financial upgradation shall also

be deferred to the extent of period of debarment due to the refusal.

26.

Cases of persons holding higher posts purely on adhoc basis shall also

be considered by the Screening Committee alongwith others. They may be

allowed the benefit of financial upgradation on reversion to the lower

post or if it is beneficial vis-a-vis the pay drawn on adhoc basis.

27.

Employees on deputation need not revert to the parent Department for

availing the benefit of financial upgradation under the MACPS. They may

exercise a fresh option to draw the pay in the pay band and the grade

pay of the post held by them or the pay plus grade pay admissible to

them under the MACPS, whichever is beneficial.

28.

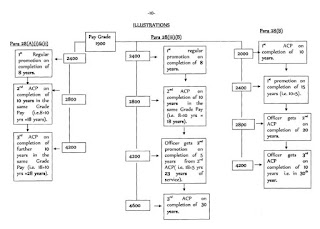

Illustrations :

A

(i) If a Government servant (LDC) in PB-l in the Grade Pay of Rs.1000

gets his first regular promotion (UDC) in the PB-1 in the Grade Pay of

Rs.2400 on completion of 8 years of service and then continues in the

same Grade Pay for further 10 years without any promotion then he would

be eligible for 2nd financial upgradation under the MACPS in the PB-1 in

the Grade Pay of Rs.2800 after completion of 18 years (8+10 years).

(ii)

In case he does not get any promotion thereafter, then he would get 3rd

financial upgradation in the PB-II in Grade Pay of Rs.4200 on

completion of further 10 years of service i.e. after 28 years (8+10+10).

(iii) However, if he gets 2nd promotion after 5 years of further service in the pay PB-II in the Grade Pay of Rs.4200 (

Asstt. Grade/Grade "C")

i.e. on completion of 23 years (8+10+5years) then he would get 3rd

financial upgradation after completion of 30 years i.e. 10 years after

the 2nd ACP in the PB-II in the Grade Pay of Rs.4600.