MACP FOR THE CENTRAL GOVERNMENT CIVILIAN EMPLOYEES – DOPT CONSOLIDATED GUIDELINES

MACP DoPT Orders 2019

No.35034/3/2015-Estt.(D)

Government of India

Ministry of Personnel, Public Grievances and Pensions

(Department of Personnel and Training)

North Block, New Delhi -110001

Dated the 22nd October, 2019

OFFICE MEMORANDUM

SUBJECT:-

CONSOLIDATED GUIDELINES REGARDING MODIFIED ASSURED CAREER PROGRESSION SCHEME FOR THE CENTRAL GOVERNMENT CIVILIAN EMPLOYEES.

The Seventh Central Pay Commission in Para 5.1.44 of its report, recommended that Modified Assured Career Progression Scheme (MACPS) will continue to be administered at 10, 20 and 30 years as before. In the new Pay matrix, the employees will move to the immediate next Level in the hierarchy. As per the recommendations, the Scheme will be available to all posts, including Group “A” posts, whether isolated or not. However, Organised Group “A” Services will not be covered under the Scheme. In other words, MACPS will continue to be applicable to all employees up to HAG level, except members of Organised Group ‘A’ Services.

2. The Government has considered the recommendations of the Seventh Central Pay Commission for continuation of MACPS and has accepted the same. The MACPS will continue to be administered at 10, 20 and 30 years as before. Under the Scheme, the employee will move to immediate next Pay Level in the new Pay Matrix.

3. The Scheme shall continue to be applicable to all regularly appointed Group “A”(except officers of the Organised Group “A” Services), “B”, and “C” Central Government Civilian Employees. Casual employees, including those granted ‘temporary status’ and employees appointed in the Government on adhoc or contract basis shall not qualify for benefits under the aforesaid Scheme. The details of the MACP Scheme and conditions for grant of the financial upgradation under the Scheme are given in Annexure-1.

4. A Screening Committee shall be constituted in each Department to consider the case for grant of financial upgradations under the MACP Scheme. The Screening Committee shall consist of a Chairperson and two members. The members of the Committee shall comprise officers holding posts which are at least one level above the level in which the MACP is to be considered and not below the rank of Under Secretary equivalent in the Government. The Chairperson should generally be a level above the members of the Committee.

5. In cases where the Appointing Authority is the President and the Screening Committee is constituted in the Secretariat of the Ministry /Department, then the power to approve the recommendations of the Screening Committee is delegated to the Secretary of such Ministry or Department. In cases where the Appointing Authority is the President and the Screening Committee is constituted in an organization (for e.g., field office, attached/subordinate office, etc), then the power to approve the recommendations of the Screening Committee is delegated to the Head of such organization. In all other cases, the power to approve the recommendations of the Screening Committee shall be with the Appointing Authority.

Also check:

MACP guidance as per recommendations of the 7th CPC

6. In order to prevent undue strain on the administrative machinery, the Screening Committee shall follow a time-schedule and meet twice in a financial year. Accordingly, cases maturing during the first-half of a particular financial year (April-September) shall be taken up for consideration by the Screening Committee meeting in the first week of January. Similarly, the Screening Committee meeting in the first week of July shall process the cases that would be maturing during the second-half of the financial year (October.,.March).

7. In so far as . persons serving in the Indian Audit and Accounts Departments are concerned, these orders issue after consultation with the Comptroller and Auditor General of India.

8. Any interpretation/ clarification of doubt as to the scope and meaning of the provisions of the MACP Scheme shall be given by the Department of Personnel and Training (Establishment-D). The MACP Scheme continues to be effective from 01.09.2008.

9. No stepping up of pay in the level would be admissible with regard to junior getting more pay than the senior on account of pay fixation under MACP Scheme.

10. Hindi version will follow.

(A. Bhattacharya)

Deputy Secretary to the Govt. of India

Annexure-I

O.M. No.35034/3/2015-Estt.(D) dated 2.10.2019

1. There shall be three financial upgradations under the MACPS, counted from the direct entry grade on completion of 10, 20 and 30 years services, respectively, or 10 years of continuous service in the same Level in Pay Matrix, whichever is earlier.

2. The MACPS envisages merely placement in the immediate next higher level in the hierarchy of the Pay Matrix as given in PART A of Schedule of the CCS (Revised Pay) Rules, 2016. Thus, the level at the time of financial upgradation under the MACPS can, in certain cases where regular promotion is not between two successive Pay Levels, be lower than what is available at the time of regular promotion. In such cases, the higher level attached to the next promotion post in the hierarchy of the concerned cadre/organisation will be given only at the time of regular promotion.

3. The financial upgradations under the MACPS would be admissible up-to level 15 in the Pay Matrix, corresponding to the Higher Administrative Grade (HAG).

Also read:

MACP – All about Modified Assured Career Progression Scheme applicable to Central Government Employees after implementation of 7th Pay Commission

4. (i) Benefit of pay fixation available _at the time of regular promotion shall also be allowed at the time of financial upgradation under the Scheme [as prescribed in Para 13 of CCS(Revised Pay Rules), 2016].

(ii) There shall, however, be no further fixation of pay at the time of regular promotion if it is in the same pay level as granted under MACPS.

(iii) However, at the time of actual promotion if it happens to be in a post carrying higher pay level than what is available under MACPS, then he shall be placed in the level to_ which he is promoted at a cell in the promoted level equal to the figure being drawn by him on account of MACP. If no such cell is available in the level to which promoted, he shall be placed at the next higher cell in that level. The employee may have an option to get this fixation done either on the date of promotion or w.e.f. the date of next increment as per the option to be exercised by him.

5. Promotions earned/upgradation granted under the MACP Scheme in the past to those grades which are in the same Level in the Pay Matrix due to merger of pay scales/upgradations of posts recommended by the Seventh Pay Commission shall be ignored for the purpose of granting upgradations under Modified ACPS. The benefit of merger will accrue w.e.f. the date of notification of the Recruitment Rules for the relevant post.

6. Fixation of pay on grant of financial upgradation under MACPS on or after 01.01.2016 shall be made as per Rule 13 of CCS (RP) Rules, 2016 issued vide Department of Expenditure notification dated 25th July, 2016 and in terms of provisions contained in DoP&T OM No. 13/02/2017-Estt.(Pay-I) dated 27.07.2017.

6.1 In cases where financial upgradation had been granted to Government Servants in the next higher Grade Pay in the hierarchy of Grade Pays as per the provisions of the MACP Scheme of 19th May, 2009, but whereas as a result of the implementation of Seventh CPC’s recommendations, substantive post held by him in the hierarchy of the cadre has been upgraded by granting a higher Pay Level in such cases the MACP already granted to him prior to 7th CPC shall be refixed in the revised pay structure at the next higher level of Pay Matrix. To illustrate, in the case of Postal Inspector (GP 4200/-) in Department of Posts, who was granted 1st MACP in the Grade. Pay of Rs; 4600/- in PB-2, he will now be granted (grade pay of Rs 4800 in the pay band PB-2) Level 8 of the Pay Matrix consequent upon upgradation of the post of Postal Inspector from GP of Rs. 420,0 to GP of Rs. 4600/Level 7 in the Pay Matrix. However, all the financial upgradations under the Scheme should be done strictly in accordance with the hierarchy of Levels in the Pay Matrix as notified vide CCS (Revised Pay) Rules, 2016.

7. With regard to fixation of his pay on grant of promotion/ financial upgradation under MACP Scheme, a Government servant has an option under FR22 (1) (a) (1) to get his pay fixed in the higher post/ Pay Level either from the date of his promotion/upgradation or from the date of his next increment viz. 1st July or 1st January, subject to provisions in the Scheme.

8. Promotions earned in the post carrying same Pay Level in the promotional hierarchy as per Recruitment Rules shall be counted for the purpose of MACPS.

9. ‘Regular service’ for the purposes of the MACPS shall commence from the date of joining of a post in direct entry grade on a regular basis either on direct recruitment basis or on absorption/re-employment basis. Service rendered on casual, adhoc/ contract basis before regular appointment on pre-appointment training shall not be taken into reckoning. However, past continuous regular service in same/another Central Government Department in a post carrying same pay level in the Pay Matrix prior to regular appointment in a new Department, without a break, shall also be counted towards qualifying regular service for the purposes of MACPS only (and not for the regular promotions). However, benefits under the MACPS in such cases shall not be considered till the satisfactory completion of the probation period in the new post.

10. Past service rendered by a Central Government employee in a State Government/Statutory Body/Autonomous body/Public Sector organization, before appointment in the Central Government shall not be counted towards Regular Service.

11. ‘Regular service’ shall include all periods spent on deputation/foreign service, study leave and all other kinds of leave, duly sanctioned by the competent authority.

12. The MACPS shall also be applicable to work charged employees, if their service conditions are comparable with the staff of regular establishment.

13. Existing time-bound promotion scheme, including in-situ promotion scheme, or any other kind of promotion scheme existing for a particular category of employees in a Ministry/Department or its offices, may continue to be operational for the concerned category of employees, if it is decided by the concerned administrative authorities to retain such Schemes, after necessary consultations or they may switch-over to the MACPS. However, these Schemes shall not run concurrently with the MACPS.

14. The MACPS is directly applicable only to Central Government Civilian employees. The Scheme may be extended to employees of Central Autonomous/Statutory Bodies under the administrative control of a Ministry/Department subject to fulfillment of conditions prescribed in DOPT’s OM No. 35034/3/2010-Estt.(D) dated 03.08.2010.

15. If a financial upgradation under the MACPS is deferred and not allowed after 10 years ina level, due to the reason of the employees being unfit or due to departmental proceedings, etc., this would have consequential effect on the subsequent financial upgradation which would also get deferred to the extent of delay in grant of first financial upgradation.

16. On grant of financial upgradation under the Scheme, there shall be no change in the designation, classification or higher status. However, financial and certain other benefits which are linked to the pay drawn by an employee such as HBA, allotment of Government accommodation shall be permitted.

17 (i). For grant of financial upgradation under the MACP Scheme, the prescribed Benchmark shall be ‘Very Good’, for all levels. This shall be effective for upgradations under MACPS falling due on or after 25.07.2016 and the revised benchmark shall be applicable for the APARs for the year 2016-17 and subsequent years.

17(ii). While assessing the suitability of an employee for grant of MACP, the Departmental Screening Committee (DSC) shall assess the APARs in the reckoning period. The benchmark for the APARs for the years 2016-17 and thereafter shall be ‘Very Good’. The benchmark for the years 2015-16 and earlier years• shall continue be as per the MACP guidelines issued vide DoPT O.M. dated 19.05.2009:

“The financial upgradation would be non-functional basis subject to fitness in the hierarchy of grade pay within the PB-I. Thereafter for upgradation under the MACPS the benchmark of ‘good’ would be applicable till the grade pay of Rs. 6600/- in PB-3. The benchmark will be ‘Very Good’ for financial upgradation to the grade pay of Rs. 7600 and above.”

For example, if a particular MACP falls due on or after 25.07.2016, the following benchmarks for APARs are applicable:

| APAR for the year | Benchmark grading for MACP for Level 11 and below | Benchmark grading for MACP for Level 12 and above |

| 2013-14 and earlier years | Good | Very Good |

| 2014-15 | Good | Very Good |

| 2015-16 | Good | Very Good |

| 2016-17 | Very Good | Very Good |

| 2017-18 and subsequent years | Very Good | Very Good |

18. In the matter of disciplinary/ penalty proceedings, grant of benefit under the MACPS shall be subject to rules governing normal promotion. Such cases shall, therefore, be regulated under the provisions of the CCS (CCA) Rules, 1965 and instructions issued thereunder.

19. The MACPS contemplates merely placement on personal basis in the immediate higher Pay Level /grant of financial benefits only and shall riot amount to actual/functional promotion of the employees concerned. Therefore, no•reservation orders/roster shall apply to the MACPS, which shall extend its benefits uniformly to all eligible SC/ST employees also. However, the rules of reservation in promotion shall be ensured at the time of regular promotion. For this reason, it shall not be mandatory to associate members of SC/ST in the Screening Committee meant to consider cases for grant of financial upgradation under the Scheme.

20. Financial upgradation under the MACPS shall be purely personal to the employee and shall have no relevance to his seniority position. As such, there shall be no additional financial upgradation for the senior employees on the ground that the junior employee in the grade has got higher pay/ Level under the MACPS. However, in cases where a senior Government servant granted MACP to a higher Grade Pay before the 1st day of January, 2016 draws less pay in the revised pay structure than his junior who is granted MACP to the higher Level on or after the rst day of January, 2016, the pay of senior Government servant in the revised pay structure shall be stepped up to an amount equal to the pay as fixed for hisjunior in that higher post and such stepping up shall be done with effect from the date of MACP of the junior Government servant subject to the fulfillment of the following conditions, namely:-

(a) both the junior and the senior Government servants belong to the same cadre and they are in the same pay Level on grant of MACP;

(b) the existing pay structure and the revised pay structure of the lower and higher posts inwhich they are entitled to draw pay are ientical;

(c) the senior Government servants at the time of grant of MACP are drawing equal or more pay than the junior;

(d) the anomaly is directly as a result o.f the application of the provisions of Fundamental Rule 22 or any other rule or order regulating pay fixation on such grant of MACP in the revised pay structure:

Provided that if the junior officer was drawing more pay in the existing pay structure than the senior by virtue of any advance increments granted to him, the provisions of this sub rule shall not be invoked to step up the pay of the senior officer.

21. Pay drawn in the level of Pay Matrix under the MACPS shall be taken as the basis for determining the terminal benefits in respect of the retiring employee.

22. In case an employee is declared surplus in his /her organisation and appointed in the same pay-scale or lower scale of pay in the new organization, the regular service rendered by him/ her in the previous organisation shall be counted towards the regular service in his/her new organisation for the purpose of giving financial upgradation under the MACPS.

23. In case of transfer ‘including unilateral transfer on request’, regular service rendered in previous organisation /office shall be counted alongwith the regular service in the new organisation /office for the purpose of getting financial upgradations under the MACPS. However, financial upgradation under the MACPS shall be allowed in the immediate next higher Pay Level in the Pay Matrix as given in CCS (Revised Pay) Rules, 2016. Wherever an official, in accordance with terms and conditions of transfer on own volition to a lower post, is reverted to the lower Post/ Grade from the promoted Post/ Pay Level before being relieved for the new organisation/office, such past promotion in the previous organisation/ office will be ignored for the purpose of MACPS in the new organisation/office.

24. If a regular promotion has been offered but was refused by the employee befote becoming entitled to an upgradation under the scheme, no financial upgradation shall be allowed as the employee has not stagnated due to lack of opportunities. If,however, financial upgradation has been allowed due to stagnation and the employees subsequently refuse the promotion, it shall not be a ground to withdrw the financial upgradation. He shall, however, not be eligible to be considered for further financial upgradation till he agrees to be considered for promotion again and in such case, the second or next financial upgradation shall also be deferred to the extent of period of debarment due to the refusal of promotion.

25. Cases of persons holding higher posts purely on adhoc basis shall also be considered by the Screening• Committee alongwith others. They may be allowed the benefit of financial upgradation on reversion to the lower post

26. Employees on deputation need not revert to the parent Department for availing the benefit of financial upgradation under the MACPS. They may exercise a fresh option to either draw pay in the level of Pay Matrix attached to the post held by them on deputation or the pay in the pay level admissible to them under the MACPS, whichever is beneficial. In case, the employee opts to draw pay in the pay level admissible to him/her under the MACPS, the.deputation (duty) allowance shall be regulated in terms of the instructions issued by DoPT vide O.M. No.2/11/2017-Estt.(Pay II) dated 24.11.2017, as amended from time to time.

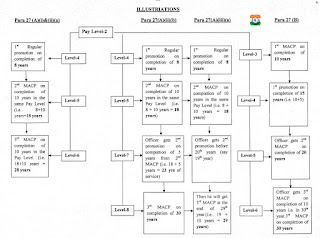

27.

Illustrations

A. (i) If a Government servant in Level 2 gets his first regular promotion in the Level 4 on completion of 8.years of service and then continues in the Level for further 10 years without any promotion then he would be eligible for 2nd financial upgradation under the MACPS in the Level 5 after completion of 18 years (8+10years).

(ii) (a) In case he does not get any promotion thereafter, then he would get 3rd financial upgradation in the Level 6 on completion of further 10 years of service i.e. after 28 years (8+10+10).

(ii) (b) However, if he gets 2nd promotion after 5 years of further service to the grade say in the Level 7 [i.e. on completion of 23 years (8+ 10+5years)], then he would get 3rd financial upgradation in Level 8 after completion of 30 years.

(iii) (a) If he gets 2nd promotion before 20th year (say 19th year), then he gets 3rd MACP, at the end of 29th year, (i.e. 10 years from 2nd promotion) provided he does not get 3rd promotion.

(iii) (b) If he gets 2nd promotion after 20th year (say in 23rd year), and there is no 3rd promotion before 30 years, then he may be allowed 3rd MACP at the end of 30 years.

B. If a Government servant in Level 2 is granted 1st financial upgradation under the MACPS on completion of 10 years of service in the Level 3 and 5 years later he gets 1st regular promotion in Level 4, the 2nd financial upgradation under MACPS (in the next level w.r.t. level held by Government servant) will be granted in Level 5 on completion of 20 years of service. On completion of 30 years of service, he will get 3rd MACP in the Level 6. However, if two promotions are earned before completion of 20 years, only 3rd financial upgradation would be admissible on completion of 10 years of service in Level from the date 2nd promotion or at 30th year of service, whichever is earlier

C. If a Government servant has been granted either two regular promotions or 2nd financial upgradation under the ACP Scheme of August, 1999 after completion of 24 years of regular service then only 3rd financial upgradation would be admissible to him under the MACPS on completion of 30 years of service provided that he has not earned third promotion in the hierarchy.

Deputy Secretary

Source:

DoPT