LTC: Admissibility of Free Sea Passage to

Service Personnel

No.AT/IV/4026/PC-8

The PCDA (AF)

The PCDA (Navy)

The CDA(IDS)

Sub : Admissibility of Free Sea Passage to Service Personnel

The case regard admissibility of free sea passage to service personnel at A&N islands was referred to MOD for Clarification. The MOD vide ID Note No.10(8)/2014-D(Mov) dt.22.4.2016 and 7.3.2018 has clarified the LTC/Concession entitlement of the service personnel posted at A & N group of Islands as under:

Service Personnel posted in A &N Islands are entitled for the following LTC/concessions as per various orders:

This issues with the approval of Jt.CGDA(P&W)

Source: http://cgda.nic.in

Office of CGDA, Ulan Batar Road, Palam Delhi

Cantt-110010

Dated 25-4-2018

ToThe PCDA (AF)

The PCDA (Navy)

The CDA(IDS)

Sub : Admissibility of Free Sea Passage to Service Personnel

The case regard admissibility of free sea passage to service personnel at A&N islands was referred to MOD for Clarification. The MOD vide ID Note No.10(8)/2014-D(Mov) dt.22.4.2016 and 7.3.2018 has clarified the LTC/Concession entitlement of the service personnel posted at A & N group of Islands as under:

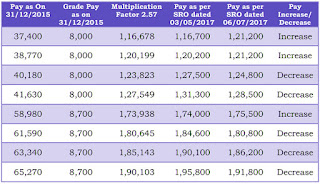

Service Personnel posted in A &N Islands are entitled for the following LTC/concessions as per various orders:

i. Normal LTC under provisions of Rue 177(A/B) and 184 of Travel Regulations.LTC/concessions / Sea Passage claims of service personnel posted at A &N group of Islands may be dealt with accordingly.

ii. In addition they are entitled to one additional free passage including sea passage to their SPR/Hometown in terms of GoI MOD letter No.5(30/07/D(Mov)dt.28th April 2010. This has been incorporated under Rule 177© of Travel regulations (2014 edition)

iii. As per GoI MoD letter No.67669/AC/PS 3(a) /1613 /D(Pay/Services) dated 13th March 1973 service personnel and their families are entitled free sea passage appropriate class once a year to Kolkatta/Chennai & back in addition to LTC

This issues with the approval of Jt.CGDA(P&W)

sd/-

Sr.ACGDA (AT-IV)

Source: http://cgda.nic.in