It

is a general view of all Central Government Employees that certain

allowances, reimbursement and advances which have been abolished or

restricted in 7th CPC report are to be allowed to continue

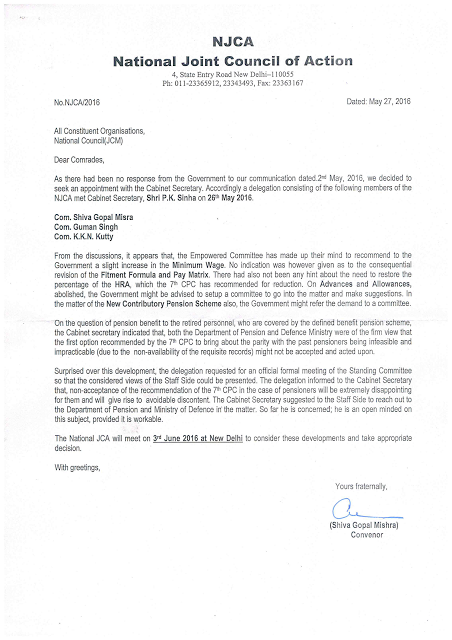

7th Pay Commission Latest News – Employees of Accounts and Audit Department

raises certain Common issues in respect of 7th Pay Commission

Recommendations which are applicable to all Central Government Employees

7th Pay Commission Latest News – As per representation made by the

employees of Accounts and Audit Department certain common issues in

respect of allowances, Interest Free Advances and Interest bearing

Advances

Issues related to Allowances:

House Rent Allowance:

Recommendation of 7th Pay Commission:

The Commission recommends that HRA be paid at the rate of 24 percent,

16 percent and 8 percent of the new Basic Pay for Class X, Y and Z

cities respectively. The Commission also recommends that the rate of HRA

will be revised to 27 percent, 18 percent and 9 percent respectively

when DA crosses 50 percent, and further revised to 30 percent, 20

percent and 10 percent when DA crosses 100 percent”

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

In para 8.7.14, the Commission took note of the link between increase

in HRA and increase in house rent after implementation of

recommendations of 6th CPC. There was a sharp rise in the index from the

first half of 2009, immediately following 6th CPC recommendations.

There is likely to a similar rise in House Rent after implementation of

recommendations of 7th CPC. Hence the existing percentage of House Rent

may be retained at the rate of 30 percent, 20 percent and 10 percent of

the new Basic Pay for Class X, Y and Z cities respectively.

Composite Transfer and Packing Grant (CTG)

Recommendation of 7th Pay Commission:

The Commission recommended that CTG should be paid at the rate of 80

percent of last month basic’s pay. However, for transfer to and from the

island territories of Andaman, Nicobar and Lakshadweep, CTG may

continue to be paid at the rate of 100 percent of last month’s Basic

Pay.

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

As the labour charges and cost of packing materials are continuously

rising, the CTG may continue to be paid at the rate of 100 percent of

last month’s Basic Pay.

Reimbursement of staying accommodation charges:

Recommendation of 7th Pay Commission:

The commission made flowing recommendations:

| Level |

Level Ceiling for

Reimbursement (Rs.) |

| 14 and above |

7500 |

| 12 and 13 |

4500 |

| 9 to 11 |

2250 |

| 6 to 8 |

750 |

| 5 and below |

450 |

For levels 8 and below, the amount of claim (up to the ceiling) may

be paid without production of vouchers against self-certified claim

only. The self- certified claim should clearly indicate the period of

stay, name of dwelling, etc. The ceiling for reimbursement will further

rise by 25 percent whenever DA increases by 50 percent. Additionally, it

is also provided that for stay in Class‘X’ cities, the ceiling for all

employees up to Level 8 would be Rs.1,000 per day, but it will only be

in the form of reimbursement upon production of relevant vouchers.

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

The main objective of the Audit Department is to carry out Audit

function which entails long periods of stay out of headquarters.

Consequently, officials at pay level 5 to 11 have to visit small towns

(at Block/Sub-division level). For such places, as per recommendations

of the 7th CPC, officials of pay level 8 and below will be entitled to

the claim without production of vouchers (ie. against self-certified

claim only), where as officials of the pay level 9 and above will have

to produce vouchers for the similar claim.

To eradicate such anomalous situation, it is submitted that claims,

as admissible upto pay level 8, may be paid without production of

vouchers against self-certified claim to all pay level officials.

Reimbursement of travelling charges:

Recommendation of 7th Pay Commission:

The commission made following recommendations:

| Level |

Level Ceiling for

Reimbursement (Rs.) |

| 14 and above |

AC Taxi charges up to 50 km |

| 12 and 13 |

Non-AC Taxi charges up to 50 km |

| 9 to 11 |

Rs. 338 per day |

| 6 to 8 |

Rs. 225 per day |

| 5 and below |

Rs. 113 per day |

Similar to Reimbursement of staying accommodation charges, for levels

8 and below, the claim (up to the ceiling) should be paid without

production of vouchers against self certified claim only.

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

In the same analogy, as mentioned against reimbursement of staying

accommodation charges above, it is submitted that claims, as admissible

upto pay level 8, may be paid without production of vouchers against

self-certified claim to all pay level officials.

Family Planning Allowance:-

Recommendation of 7th Pay Commission:

The Pay Commission has recommended to abolish the Family Planning Allowances

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

This is an incentive for promoting small family norms and therefore, it needs to be continued.

Interest free advances:

Medical Advance:

Recommendation of 7th Pay Commission:

The pay Commission has recommended abolition of Medical Advance.

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

As per the existing practice, medical advance is paid to an employee

to the extent of 90% of the estimated cost of treatment in case of

treatment of self and dependents. Cost of treatment for illness

particularly of critical/life threatening ailments, such as heart

transplant/ cancer/ kidney transplant etc., even under CGHS rules, is

extremely expensive. It is also pertinent to note that many hospitals

even in emergent situations insist on advance payment before commencing

treatment/surgery. It is very difficult for a low paid employee such as

MTS/LDC/UDC etc or even for group ‘B’ and ‘A’ officers to make available

large amounts required for medical treatment. Without medical advance,

an official will have great difficulty in getting proper/appropriate

medication.

Therefore, it is submitted that medical advance may be continued with as per existing practice.

TA Advance:

Recommendation of 7th Pay Commission:

The pay Commission has recommended abolition of TA Advance.

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

The main function of IA &AD is auditing of Central/State

Government/ PSUs etc. These auditee units are spread across the states

down to the block/Panchayat level. In order to discharge audit

responsibility, touring is a continuous requirement. It is not an

occasional tour for short period, expenditure of which can be met out by

the individual and reimbursement claimed subsequently. The officials

have to be on tour continuously for upto a quarter (i.e 03 months) or

even more.

For an official at pay level 6(Senior Auditor), as per the

recommendations of the 7th CPC, the tour allowance for a day works out

to Rs. 1770/- (Rs. 750 for accommodation+225 for travelling +Rs. 800 for

food bills) and for a month it would be Rs. 53250/-. Besides, he has to

incur expenditure for to and fro (i.e Hqrs. to field office and back)

train/ bus fare. Monthly salary of a pay level 6 employee, as per

recommendations of 7th CPC is Rs. 35400/-. As is clearly brought out,

the likely monthly expenditure on tour will be significantly more than

the employees’ monthly salary.

Therefore, advance is necessary to defray tour expenditure for

performing official duties. This will create huge administrative issues

in the department and adversely impact the Audit functions.

In view of the above, TA Advance, requires to be continued and paid as per extant provisions.

LTC Advance:

Recommendation of 7th Pay Commission:

The pay Commission has recommended abolition of LTC Advance.

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

Under LTC facility the expenses incurred on travel to visit the

destination is reimbursable. Advance upto 90% of expenses on travel to

visit the destination place is admissible. This amount serves as great

help to the employees to undertake the journey in arranging train/air

tickets. Without this advance, the employees will find it difficult to

purchase train/air tickets for his family Besides travelling expenses, an official has to incur expenditure on account of Boarding and lodging/local travel also.

As per the recommendation of 7th CPC, officials of pay level 05 to 08

are entitled to travel by train. The travel tickets for family of four

will cost more than Rs. 18000/- for a journey from Delhi to

Thiruvananthapuram. Further, for level 9 and above the return tickets in

economy class for the same destination i.e. Delhi to Thiruvananthapuram

will cost more than Rs. 2 lakh.

A government official cannot afford such a huge amount to spent

upfront for performing journey for availing home town LTC or All India

LTC. Hence LTC advance is required to be continued as per extant

provisions.

Bicycle Advance, Warm Clothing Advance:

Recommendation of 7th Pay Commission:

The pay Commission has recommended abolition of these Advances.

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

These advances may continued to be paid as per existing rules as

these are admissible only to low paid employees upto Grade pay of Rs.

2800 /- (Level 5)

Festival advance, advance in the event of natural calamities like Flood, Drought, Cyclone etc.

Recommendation of 7th Pay Commission:

The pay Commission has recommended abolition of these Advances.

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

These advances may continue to be paid as per existing rules as these

interest free advances are payable to Group ‘B & C’ employees as a

welfare measure.

Advance of TA to a family of a deceased Govt. employee

Recommendation of 7th Pay Commission:

The pay Commission has recommended abolition of this Advance.

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

This advance may continue to be paid as per existing rules as this

helps the family of a deceased Govt. employee to cope with immediate

expenses for travel to their place of settlement.

Interest Bearing Advances:-

Motor Car/Motor Cycle Advance.

Recommendation of 7th Pay Commission:

The pay Commission has recommended abolition of this Advance.

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

The Pay Commission has abolished the Motor Car/Motor Cycle Advance on

the plea that there are several schemes available in market. There are

several schemes in the markets for House Building Advance also. However,

the Pay Commission has not only recommended to continue with HBA but

also proposed to increase the ceiling. Therefore, the plea of the

commission to discontinue MCA on the basis that schemes for purchase of

vehicles are available in the market does not hold good.

Further, several documentation/guarantees are required for seeking

the said advances from the market. As it is convenient and safe for a

Government Servant to avail such advances from the office without any

hassles, these interest bearing advances may be continued as per the

extant provisions.

Fixed Medical Allowance (FMA) to Central Government Pensioners

Recommendation of 7th Pay Commission:

The Commission has maintained status quo of the Fixed Medical Allowance which is presently paid @ Rs. 500/- per month.

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

The costs have increased for medicines, consultations fees and

Pathological Tests required for day to day medical treatment. This has

risen at a much steeper rate than that of the General Price Index. A

large number of pensioners are residing in remote areas or villages

having no access to CGHS dispensaries and as such are wholly dependent

on the paltry amount of Fixed Medical Allowance for day to day

treatment.. Therefore it needs to be revised to at least Rs. 2000/- per

month.

Modified Assured Career Progression Scheme (MACPS) :

Recommendation of 7th Pay Commission:

Assured Career Progression was introduced in 1999 with a view to

grant at least two financial up gradations at an interval of 12 and 24

years where officials are stagnating for want of promotion. It was

further modified to 03 financial up gradations on the recommendations of

the 6th CPC. However, the 7th CPC recommended continuing with the same without any change. Also

the bench mark has been increased from ‘Good’ to ‘ Very Good’

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

There should be at least four financial upgradations in entire

service career of an employee at regular interval of 8 years. Hence, the

MACPS may be granted to an employee after completion of 8, 16, 24 and

32 years of service.

Further, the bench mark for financial up gradation may be continued

as per the existing practice – i.e. the bench mark prescribed for the

post for promotion.

Transport Allowance (TPTA)

Recommendation of 7th Pay Commission:

The 7th CPC has just revised the Transport Allowance by merging 125%

of DA with the existing rate of transport allowance. The revised rates

are as mentioned below:

| Pay level |

Proposed (Higher TPTA Cities) |

Proposed (Other TPTA Cities) |

| 9 and above |

7200+DA |

3600 +DA |

| 3 to 8 |

3600+DA |

1800 + DA |

| 1 and 2 |

1350+DA |

900 + DA |

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

The following is proposed for the revised Transport Allowance (TPTA)

| Pay level |

Proposed (Higher TPTA Cities) |

Proposed (Other TPTA Cities) |

| 9 and above |

10000 + DA |

5000 + DA |

| 3 to 8 |

5000 + DA |

2500 + DA |

| 1 and 2 |

2500 + DA |

1250 + DA |

Child Care Leave (CCL):

Recommendation of 7th Pay Commission:

The 7th CPC has proposed that CCL should be granted at 100 percent of

the salary for first 365 days, but at 80 percent of the salary for the

next 365 days. However, CCL has been extended to single parent also.

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

It is proposed that the CCL be paid at 100 percent of salary for the entire period.

Children Education Allowance (CEA):

Recommendation of 7th Pay Commission:

The Commission has recommended CEA @ Rs. 2250/- per month and Hostel Subsidy @ Rs. 6750/- per month.

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

Keeping in view the steep rise in tuition fees, cost of stationery,

Books, Uniform etc. the CEA and Hostel Subsidy may be increased @ Rs.

3000/- and @ Rs. 8000/- per month respectively.

Special Casual Leave (SCL):

Recommendation of 7th Pay Commission:

SCL is granted to employees to cover their absence from duty for

various occasions like sports events, cultural activities, participation

in Republic Day Parade, voluntary blood donation, Trade Union meetings,

etc. Full pay is granted during SCL and it can be sanctioned with

retrospective effect also.

The Pay Commission has expressed its concern at the widespread use of

SCL as a means of getting away from duty. However, because of the

extensive scope and case specific nature of this leave, no concrete

recommendations have been made.

It has suggested that the government may, however, consider the

following: (a) Review the purposes for which SCL is presently granted.

(b) Limit the number of purposes for which an employee can be granted SCL in a year.

(c) Limit the total number of days that an employee can be granted SCL in a year.

What is to be changed / taken care of in this issue on implementation of 7th Pay Commission Report ?

Since SCL is granted to employees to cover their absence from duty

for various occasions like sports events, cultural activities,

participation in Republic Day Parade, voluntary blood donation, Trade

Union meetings/ casting votes in their constituency, it may be continued

to be granted as per existing practice.

Source:

Indian Accounts and Audit Department