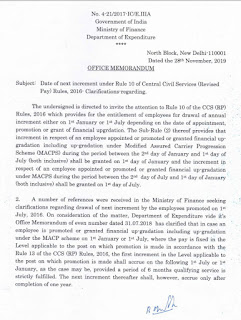

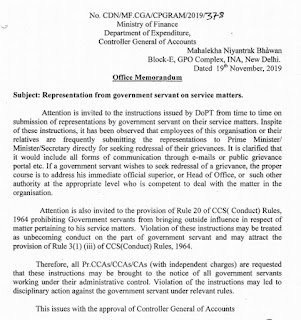

MACP CAT Chandigarh

Ignore the promotion received for MACP purposes by the post bearing the same Grade Pay

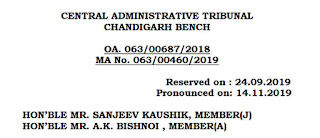

CENTRAL ADMINISTRATIVE TRIBUNAL

CHANDIGARH BENCH

OA. 063/00687/2018

MA No. 063/00460/2019

Reserved on : 24.09.2019

Pronounced on: 14.11.2019

HON’BLE MR. SANJEEV KAUSHIK, MEMBER(J)

HON’BLE MR. A.K. BISHNOI , MEMBER(A)

- Shalini Naagi wife of Sh. Suraj Prakash, aged 49 years r/o H.

No. 261, Gurdev Nagar, Zirkpur, Distt. Mohali (Pb) Office

Superintendent, (Group ‘B’ Non Gazetted), Office of Additional Surveyor

General, Northern Zone, Survey of India, Chandigarh.

- Satbir

Singh son of Sh. Surjan Singh, aged 59 years, r/o H. No. 565, Sector

32-A, Chandigarh, Office Superintendent, (Group „B‟ Non-Gazetted) Office

of Director HP GDC, Survey of India, Chandigarh.

- Habib Ahmad

Siddiqui son of Late Sh. N.M. Siddiqui, aged 59 years r/o H. No. 603/B,

Sector 32- A, Chandigarh, Office Superintendent, (Group „B‟ Non

Gazetted) Office of Director Punjab, Haryana and Chandigarh GDC, Survey

of India, Chandigarh.

…APPLICANTS

(Through Shri R.C. Sharma, Advocate)

VERSUS

- Union of India, through Secretary to Government of

India,Ministry of Science and Technology, New Mehrauli Road, Block C,

Admin, New Delhi-110 016.

- The Surveyor General of India, Hathibarkala Estate, Dehradun, Uttrakhand.

- The Additional Surveyor General, Northern Zone, Survey of India, Sector 32-A, Chandigarh.

- Director, Punjab, Haryana and Chandigarh GDC, Survey of India, Sector 32-A, Chandigarh.

- Director, Himachal Pradesh GDC, Survey of India, Sector 32-A, Chandigarh.

…….RESPONDENTS

(Through Shri K.K. Thakur, Advocate)

ORDER

MR. A.K. BISHNOI, MEMBER (A):

The applicants have filed the present Original Application seeking the following reliefs:

“It

is respectfully prayed that in view of the submissions made above this

Hon’ble Tribunal may be pleased to set aside the impugned

letters/ orders impugned communications/letters dated 22.05.2017 of the

Respondent No.1 (Annexure A-6) and impugned letters dated

09.06.2017 and 01.12.2017 of the respondent number 2 (Annexure A-7 and

A-8) effecting reversal and cancellation of the benefit of MACP

granted to the applicants.”

Also check:

IMPLEMENTATION OF HONARABLE SUPREME COURT ORDER ON MACP

SCHEME

2. Briefly, the facts of the case are as follows:

2.1 On implementation of Sixth Central Pay Commission (CPC) with

effect from 01.01.2006, both the posts of Assistant and Office

Superintendent (OS) were merged and assigned the same pay band and

grade pay i.e. Pay Band of Rs. 9300-34800 (PB 2) with Grade Pay of Rs.

4200/-. On 15.06.2009, MACP Scheme was notified requiring financial

upgradation on completion of 10, 20 and 30 years of service or 10 years

of service in same grade pay.

2.2 The applicants were

granted third MACP with effect from 30.07.2014, 27.09.2013 and

16.12.2012 vide letters dated 28.07.2014,

03.03.2014 and 03.01.2013 respectively on completion of 30 years of

service and on remaining in the same grade pay for ten years. Some

persons junior to the applicants who had not been promoted, were granted

the benefit of third MACP with Grade Pay of Rs.4600/-. The

applicants continued to receive pay and allowances on the basis of pay

fixed after grant of MACP. However, through communication dated

22.05.2017, it was informed by respondent no.1 to respondent no.2 that

MACP was not admissible to the applicants as the promotion from

the post of Assistant to OS cannot be ignored for this purpose.

2.3 Subsequently, vide orders dated 09.06.2017 and 01.12.2017

(Annexures A-7 and A-8), the grant of MACP to the applicants was

reversed. The applicants thereafter submitted representations to

reconsider the decision of reducing the grade pay (Annexures A-9, A-10

and A-11) but no relief was granted by the respondents. Applicants have

relied on the judgment rendered by the Hon‟ble Delhi High Court in

Government of NCT of Delhi & Anr. Vs.

S.K. Saraswat & Ors. decided on 09.05.2016 to fortify their stand.

3. The respondents in their counter reply have submitted that the

applicants were promoted to the post of Office Superintendent from the

post of Assistants on the dates as given above and were performing

higher duties, but, in view of the merger of pay scales of Assistant and

Office Superintendent as per Sixth CPC, the applicants were not granted

any financial benefit on promotion from Assistant to the post of

Superintendent at that stage. But, later on, as per the clarification

dated 07.01.2013 received from Ministry of Finance, the applicants were

granted the benefit of pay fixation by giving 3% increment and on

completion of 30 years of regular service, they were granted third MACP

with Grade Pay of Rs. 4600/- in PB-3 of Rs. 9300-34800. However, later

on in view of some query raised, vide letter dated 22.05.2017, it was

informed as follows:-

- Assistants who have already received MACP in the Grade Pay of

Rs. 4600/- are not eligible for any financial benefit on regular

promotion to the post of Office Superintendent.

- No MACP is eligible to Office Superintendent by ignoring his promotion from the post of Assistant to Office Superintendent.

3.1. In view of the above instructions, the third MACP benefits

granted to the applicants were cancelled and the fixation of pay in

respect of the concerned officers was carried out as per SGO‟s letter

dated 09.06.2017 (Annexure A-7).

3.2. Respondents have

further submitted that they always have a right to rectify the mistake

and in this regard, they have cited the

judgments in Jagdish Prajapati Vs. the State of Rajasthan and Ors., 1998

(2) ATJ, P-286, Anand Prakash Vs. State of Punjab, 2005 (4)

RSJ 749 and Raj Kumar Batra Vs. State of Haryana, 1992 (1) SCT 129.

4. Shri R.C. Sharma, learned counsel appearing on behalf of the

applicants vehemently contended that the action of the respondents in

withdrawing the MACP benefits was contrary to the spirit of the Scheme

and in this regard specifically referred to para 5 of the MACP Scheme

according to which where two posts have been merged and after merger

carry the same grade pay, then the effect of promotion from one of these

posts to the other shall be ignored for the purpose of granting

upgradation under the MACP.

5. Shri K.K. Thakur, learned counsel for the respondents, on the

other hand, argued that in terms of para 8 of the MACP Scheme,

promotions earned in the post carrying same grade pay in the promotional

hierarchy, shall be counted for the purpose of MACP.

6. We have carefully gone through the pleadings on record and also

the arguments advanced by the learned counsel for both sides. We have

also considered the judgments cited by the two sides.

7. For clarity of understanding some parts of the MACP Scheme are extracted below:

“2. The MACPS envisages merely placement in the immediate next higher

grade pay in the hierarchy of the recommended revised pay bands and

grade pay as given in Section1, Part-A of the first schedule of the CCS

(Revised Pay) Rules, 2008. Thus, the grade pay at the time of financial

upgradation under the MACPS can, in certain cases where regular

promotion is not between two successive grades, be different than what

is available at the time of regular promotion. In such cases, the higher

grade pay attached to the next promotion post in the hierarchy of the

concerned cadre/ organization will be given only at the time of regular

promotion.

xxxx xxxx xxxx

5. Promotions earned / upgradations granted under the ACP Scheme in

the past to those grades which now carry the same grade pay due to

merger of pay scales / upgradations of posts recommended by the Sixth

Pay Commission shall be ignored for the purpose of granting upgradations

under Modified ACPs.

Illustration - 1

The pre-revised hierarchy (in ascending order) in a particular organization was as under:-

Rs. 5000-8000, Rs. 5500-9000 & Rs. 6500-10500.

(a) A Government servant who was recruited in the hierarchy in the

pre-revised pay scale Rs. 5000- 8000 and who did not get a promotion

even after 25 years of service prior to 1.1.2006, in his case as on

1.1.2006 he would have got two financial upgradations under ACP to the

next grades in the hierarchy of his organization, i.e., to the

pre-revised scales of Rs. 5500-9000 and Rs. 6500-10500.

(b) Another Government servant recruited in the same hierarchy in the

pre-revised scale of Rs. 5000- 8000 has also completed about 25 years

of service, but he got two promotions to the next higher grades of Rs.

5500-9000 & Rs. 6500-10500 during this period.

In the case of both (a) and (b) above, the promotions/financial

upgradations granted under ACP to the pre-revised scales of Rs.

5500-9000 and Rs. 6500-10500 prior to 1.1.2006 will be ignored on

account of merger of the pre-revised scales of Rs. 50008000, Rs.

5500-9000 and Rs. 6500-10500 recommended by the Sixth CPC. As per CCS

(RP) Rules, both of them will be granted grade pay of Rs. 4200 in the

pay band PB-2. After the implementation of MACPS, two financial

upgradations will be granted both in the case of (a) and (b) above to

the next higher grade pays of Rs. 4600 and Rs. 4800 in the pay band

PB-2.”

8. Para 8 of the Scheme is reproduced as follows:

“8. Promotions earned in the post carrying same grade pay in the

promotional hierarchy as per Recruitment Rules shall be counted for the

purpose of MACPS.

8.1 Consequent upon the implementation of Sixth CPC’s

recommendations, Grade pay of Rs. 5400 is now in two pay bands viz.,

PB-2 and PB-3. The grade pay of Rs. 5400 in PB-2 and Rs.5400 in PB-3

shall be treated as separate grade pays for the purpose of grant of

upgradations under MACP Scheme.”

9. This issue relating to the effect of merger of pay scales has been

examined in extensive and minute detail by the Hon’ble High Court of

Delhi in S.K. Saraswat (supra), the relevant portions of the judgment

are extracted below:

“4. In order to appreciate and understand the controversy, we would

like to refer to the basic facts. The respondents, 55 in

number are direct appointees to the post of Principal. Their pay-

scale as in the case of Education Officer and Assistant Director of

Education prior to the implementation of the Sixth Pay Commission was

Rs.10,000 – 15,200. The pre-revised pay scale in the promotional post of

Deputy Director of Education was Rs.12,000 – 16,500. On the

recommendation of the Sixth Pay Commission, the pay scales of Principal,

Education Officer and Assistant Director of Education were enhanced and

merged with the pay scale of Deputy Director of Education, i.e.

Rs.12,000 – 16,500. Accordingly, employees holding the post of

Principal, Education Officer, Assistant Director of Education or Deputy

Director of Education became entitled to an equal/identical pay-scale of

Rs.12,000 – 16,500, and revised pay scale of Grade Pay of Rs.7600 in

Pay Band -3 [Rs.15,600 – 39100]. It is in this factual matrix that the

issue arises whether the Tribunal was justified in accepting the plea

and contention of the respondents that they would be entitled to first

financial upgradation in the Grade Pay of Rs.8700, second financial

upgradation in the Grade Pay of Rs.8900 and third financial upgradation

in the Grade Pay of Rs.10000.

5. As noted above, the petitioners herein had earlier issued

letter dated 22nd October, 2009 accepting the said position, but have

later on changed their stand and stance and have positioned that the

respondents would be entitled to financial upgradation only in the Grade

Pay of Rs.7600 in Pay Band-3. In other words, there would not be any

increase in grade pay of Rs 7600, but respondents would be entitled to

benefit in the form of increments under Fundamental Rule 22(1)(a)(i).

xxxx xxxx xxxx xxxx

7. xxxx xxxx xxxx xxxx

The MACPS envisages merely placement in the immediate next higher

grade pay in the hierarchy of the recommended revised pay bands and

grade pay as given in Section1, Part-A of the first schedule of the CCS

(Revised Pay) Rules, 2008. Thus, the grade pay at the time of financial

upgradation under the MACPS can, in certain cases where regular

promotion is not between two successive grades, be different than what

is available at the time of regular promotion. In such cases, the higher

grade pay attached to the next promotion post in the hierarchy of the

concerned cadre/organization will be given only at the time of regular

promotion.

xxxx xxxx xxxx xxxx

12. Paragraph 5 of the MACP Scheme refers to both- upgradations

granted under the erstwhile ACP Scheme and promotions earned in the past

to grades which have merged as a result of merger of pay-scales or

upgradation of posts. These have to be ignored, and the reason is

illuminate. Merger of pay scales nullifies and negates the very

objective and purpose of the Scheme. Thus, promotions earned or

upgradations granted under the ACP Scheme when they have merged, either

as a result of merger of posts or pay scales, have to be ignored for the

purpose of granting upgradations under the MACP Scheme. Mandate of Rule

4 is clarified by way of an illustration, which is instructive. A

government servant, recruited in the hierarchy in the pre-revised

pay-scale of Rs.5000-8000 and granted financial upgradations in the

pre-revised pay-scale of Rs.5500-9000 and Rs.6500-10500, on merger of

the aforesaid three pay-scales would be entitled to financial

upgradations in the Grade Pay of Rs.4600 and Rs.4800 in Pay Band-2. Such

government servant would not be paid the Grade Pay of Rs.4200 in Pay

Band-2, which is the grade pay corresponding to pre-revised pay-scales.

The reason is that pay scales of Rs.5000-8000, Rs.5500-9000 and

Rs.6500-10500, have been merged into one pay-scale.

xxxx xxxx xxxx xxxx

17. Paragraph 8 also deals with computation for the purpose of MACP

Scheme. In the beginning itself, we would say and accept that paragraph 8

is ambiguous and confusing. It is not happily worded. One way of

reading the said paragraph, which consists of one sentence, is in the

manner suggested by the petitioners i.e. promotions in the hierarchy

which have the same grade pay shall be counted for the purpose of MACP

Scheme. In other words, if the promotional post carries the same grade

pay, the promotion will still be counted or treated as financial

upgradation for the purpose of the MACP Scheme. However, this

interpretation would be counter to and is in conflict with the precept

and foundation of the MACP Scheme, which, as noticed above, refers to

the immediate next higher grade pay in the hierarchy given in Section 1,

Part-A of the first schedule of the Rules. The difficulty in accepting

this interpretation is that it will over-turn the basis and edifice of

the said Scheme and would be contrary to paragraphs 1, 2, 4, 5 and 6.2.

We have already noticed these paragraphs, including paragraph 2 and

interpreted the same. Paragraph 2 states that financial upgradation

under the MACP Scheme cannot be understood and applied with reference to

promotional pay-scales, for the same can be different. This is clear

from the second sentence of paragraph 2. The third and the last sentence

of paragraph 2 by way of an illustration accepts that the higher grade

pay attached to the next promotional post in the hierarchy will be given

at the time of regular promotion. We would observe that use of word

“higher” in the last sentence is for the purpose of demonstration to

rule out confusion and ambiguity. It is possible that the next higher

promotional post may well have pay-scale of the lower post. It is in

this context that the recommendations of the Sixth Pay Commission in

paragraph 6.1.15 are relevant. If the legislature i.e. the Government,

which had issued the Scheme, wanted to restrict financial upgradation

and not collate it to the next higher grade pay in the hierarchy, it

would have stipulated as such in Section 1, Part-A of the Rules. The

said stipulation, would have been properly clarified and so stated in

paragraph 2 itself. The second sentence of paragraph 2 expressly and

clearly states that the grade pay at the time of financial upgradation

under the MACP Scheme can in some cases be different from the

pay-scale/grade pay applicable on regular promotion. The second sentence

does not refer only to the situation where the grade pay is higher in

the promotional post. The third sentence in paragraph 2 is also by way

of an illustration. Consequence of the interpretation, as suggested by

the petitioners would be an absurdity, contradiction and cause hardship.

We would hesitate to observe that this was the legislative intent. Such

interpretation would frustrate the core foundation of the Scheme.

xxxx xxxx xxxx xxxx

18. In view of the aforesaid discussion, we do not find any merit in

the present writ petition and the same is dismissed. In the facts of the

present case, there will be no order as to costs.”

10. It can clearly be seen that the present case is squarely covered by the judgement of the Hon‟ble High Court of Delhi in

S.K.

Saraswat (supra).

11. From a reading of Para 5 of the MACP Scheme, it is abundantly

clear that the case of the applicants is fully governed by the said

provision. Further, from the illustration given with Para 5 of the MACP

Scheme, there is no doubt left whatsoever. Para 8 of the Scheme is of a

general nature, in a different context and cannot be said to have

overriding effect on Para 5 of the Scheme, which is very specific.

12. As for the case law cited by the respondents, in the facts and

circumstances of the case they lend no support to the arguments advanced

by the respondents.

13. In view of the above, the OA is allowed and the impugned orders

are set aside. The applicants shall be granted all consequential

benefits within a period of sixty days of the receipt of a certified

copy of this order. No order as to costs.

(A.K. Bishnoi), Member (A)

(Sanjeev Kaushik), Member (J)

Source: CAT Chandigarh