7th CPC: Revision of Pay and Allowances of retired/released

Armed Forces Officers wef 01.01.2016 on re-employment in Armed Forces -

MoD Order

No.1(14)/2017-D(Pay/Services)

Government of India

Ministry of

Defence

New Delhi, dated the 09-1-2018

To

The Chief of the Army Staff

The Chief of the Naval Staff

The

chief of the Air Staff

Subject:

Pay and allowances of Retired/Released Armed Forces

Officers on re-Employment in the Armed Forces

Sir,

The

pay fixation of re-employed officers on re-employment in Armed forces,

is being done in accordance with this Department's letter

No.1/69/2008/D(Pay/Services) dated 24 July 2009. Officers re-employed in

Defence services after retirement have been excluded from the purview

of the Army/Navy/Air Force Officers Pay Rules/Regulations, 2017 vide

Rule 2 thereof. The question of extension of the benefit of the revised

pay rules to these officers and the procedure to be followed for fixing

their pay in the revised pay structure has been considered by the

Government. The president is pleased to decide that the pay fixation in

respect of the Officers who were in/came into re-employment on or after

1st January,2016 will be done in accordance with the provisions

contained in this order. This order will cover all re-employed officers

on re-employment in Armed Forces.

2. Exercise of Option: Re-employed

officers who become eligible to elect revised pay structure in

accordance with these orders should exercise their option in the manner

laid down in Rule 5 and Rule 6 of the Army/Navy/Air Force Officers Pay

Rules/Regulations, 2017,within one hundred and eighty days from the date

of issue of these orders or in cases where the existing scales of pay

of the posts held by them are revised subsequent to the issue of these

within one hundred and eighty days of the date of such order. This

facility of option is avilable to the re-employed officers who were

re-employed before 1.1.2016 only.

Fixation / drawal of pay of Officers re-employed prior to 01.01.2016

and who were in re-employment as on 01.01.2016:

3.

(a) The initial pay of a re-employed officer who elects or is deemed to

have elected to be governed by the revised structure from the 1st day

of January, 2016 shall be fixed in accordance with the provisions

contained in Rule 7 of the Army/Navy/Air Force Officers Pay Rules/

Regulations, 2017. Revised Pension (excluding the ignorable portion of

pension,if any), as admissible on relevant date of coming over to the

revised pay structure,effective from 1.1.2016 or later, shall be

deducted from his/her pay in accordance with the general policy of the

Government on fixation and subsequent drawal of pay of re-employed

Officers. Revised Military Service Pay and Dearness Allowance thereon

shall be payable from 1.1.2016.

(b) In addition to the pay so

fixed, the re-employed officer would continue to draw the retirement

benefits he / she was permitted to draw in the pre-revised scales, as

modified based on the recommendations of the Seventh Central Pay

Commission, orders in respect of which have been issued separately by

the Department of Ex-Servicemen Welfare.

(c) In the case of

persons who were already on re-employment as on 01.01.2016, the pay may

be fixed on the basis of these orders, with effect from the date of

coming over to the new pay structure, i.e. 01.01.2016 or later, as per

the option exercised by them in terms of para 2 above. In such cases,

their term would be determined afresh as if they have been re-employed

for the first time from such date of coming over to the new Pay

Structure.

4. Officers Re-employed on or after 01-01-2016

Officers who are re-employed on or after 1-1-2016 shall be allowed to draw

pay only in the revised Pay Structure.

(a) Officers who Retired from pre-revised scales of pay and were

re-employed in the Revised Pay Structure.

The

initial pay shall be fixed in the revised pay structure in accordance

with Rule 7 of Army/Navy/Air Force Officers Pay Rules/Regulation 2017

read with para 5 below, with reference to the rank held at the time of

retirement. Military Service Pay and Dearness Allowance thereon shall be

payable from 1-1-2016. However, an amount equivalent to the revised

pension (excluding the ignorable portion of pension) effective from

1-1-2016 or after shall be deducted from his pay so fixed in accordance

with the general policy of the Govt on fixation of pay of re-employed

officers.

(b) Officers who retired and are re-employed in the Revised Scale of

pay.

The

initial pay in the Level (read with Para 5 below) shall be fixed at the

same cell in the Level as the last pay drawn. Military Service Pay and

Dearness Allowance thereon shall be payable from 1-1-2016. Having fixed

the Pay in the manner indicated, an amount equivalent to the revised

pension (excluding the ignorable portion of pension) effective from

1-1-2016 or after shall be deducted from his pay so fixed in accordance

with the general policy of the Govt on fixation of pay of re-employed

officers.

5.

Pay in the Level. In the case of

retired Armed Forces Officers (a) who were re-employed before 01.01.2016

(b) who retired from pre-revised pay scales and were re-employed on or

after 01.01.2016 in the revised pay structure, and (c) who retired and

are re-employed in the revised pay structure, on their re-employment in

the Armed Forces, the pay of the officers will be fixed by granting them

the pay in the Level of the rank held by them at the time of their

retirement or Level of Colonel (Time Scale)'s pay whichever is lower.

Ignorable part of Pension

6.

The President is also pleased to enhance the ignorable part of pension

from Rs. 4000/- to Rs.15,000/- (Rupees Fifteen Thousand only) in the

case of Commissioned Service Officers who retire before attaining the

age of 55 years. The existing limits of military pensions to be ignored

in fixing the pay of re-employed Officers will therefore, cease to be

applicable to cases of such Officers who are re-employed on or after

1-1-2016. As Brigadiers retire at the age of 56 years they will not be

eligible for ignorable portion of pension.

Drawal of increments

7.

Once the initial pay of the re-employed officer has been fixed in the

manner indicated above, he will be allowed to draw normal increments as

per the provisions of Rule 9 and 10 of Army/ / Air Force/ Navy Officers

Pay Rules/ Regulations, 2017.

8. Further, the existing ceiling of

Rs. 80,000/- for drawal of pay plus gross pension on reemployment is

enhanced to Rs.2,25,000/-, i.e. the pay plus MSP @Rs.15,500/- plus gross

pension should not exceed the ceiling of Rs.2,25,000 pm, the maximum

basic pay prescribed for officers in Level 17 under Army/Navy/Air Force

Officers Pay Rules/Regulations, 2017.

9.

Allowances:

The drawal of various allowances and other benefits in the revised

structure based on pay shall be regulated with reference to pay that is

fixed on re-employment. Pay for these allowances will be the pay fixed

before deducting the pension.

10.

Gratuity/Death cum Retirement Gratuity

- The re-employed officers shall not be eligible for any gratuity/Death

cum Retirement Gratuity for the period of re-employment.

11. Some illustrations to cater for pay fixation in various situations

arising are given in Appendix 'A' to this letter.

12. These Orders shall take effect from 1.1.2016. These Orders supersede the

existing orders on the subject.

13.

An undertaking may be obtained from re-employed officers who opt / are

deemed to have opted for the revised pay structure to the effect that,

they understand and agree that the special dispensation provided through

this order is subject to the condition of deduction of pension as

admissible to them from time to time, where ever required as per extant

instructions and also to recovery in case of over-payment made, if any.

14.

This letter issues with the approval of Department of Personnel &

Training vide their ID Note No. 1279783/2017-Estt.(Pay-II) dated

12.12.2017 and concurrence of Ministry of Defence (Finance) vide their

ID Note No.3(16)/08-AG/389-PA, dated 05-01-2018.

Yours faithfully,

(M. Subbarayan)

Joint Secretary to the Government of India

UNDERTAKING

(To

be given by officers who are on re-employment on or after 01.01.2016

and who have chosen / are deemed to have chosen to be governed by the

Army/ Navy/ Air Force Officers Pay Rules/Regulations, 2017, in terms of

MoD/ D(Pay/Services) order No. ______________ dated ____________ )

I,

_______________________, S/o / W/o / D/o ______________________ ,

hereby undertake that I understand and agree that the special

dispensation of pay fixation under the Army/ Navy/Air Force Officers Pay

Rules/ Regulations, 2017 provided to me through the letter No.

___________________ dated ____________ is subject to the specific

condition of deduction of pension as admissible to me from time to time,

wherever required as per extant instructions and also to recovery in

case of overpayment made, if any.

Signature. ___________________

Name ___________________

Designation___________________

Date:

Place:

Appendix 'A'

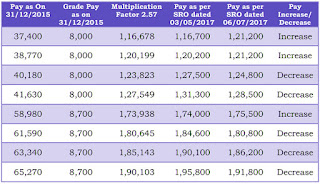

ILLUSTRATION - 1

1.

Initial pay fixation in revised scales of a re-emp officer who has

retired in pre-revised scales and re-emp in pre-revised scales prior to

01 Jan 2016. Example of a Col retired on 31 Jul 2015 and re-emp on 01

Aug 2015.

(a) Col Retd on 31 Jul 2015

| (i) | Pay in Pay Band | Rs. 55000/- |

| (ii) | Grade Pay | Rs. 8700/- |

| (iii) | MSP | Rs 6000/- |

| (iv) | DA @ 119% | Rs 82943/- |

| Total | Rs 152643/- |

(b) Fixation of Pay on Date of Re-employment as on 01 Aug

2015

(c) Re-fixation of Pay on 01 Jan 2016 in accordance with Pay Rule /

Regulations

| (i) | Level | - Level 13 |

| (ii) | Revised Pay (63700 x 2.57) | - Rs 163709/-

|

| (iii) | Rounded off to next higher Cell in Level 13 | -

Rs 165400/- |

| (iv) | Revised Military Service Pay | - Rs 15500/-

|

| Total | - Rs 180900 |

(d) Revised Pension

| (i) | Rs 34850 x 2.57 | Rs 89565/- |

(e) Fixation of Pay on Re-employment

| (i) | Pay | Rs 165400/- |

| (ii) | Less Pension - Ignorable limit (89565 - 15000)

| Rs 74565/- |

| (iii) | Net Pay admissible | Rs 90835/- |

(f)

As pay has been fixed on 01 Jan 2016, the re-employed officer will be

entitled for annual increment as per the existing provisions of Army/

Navy/ Air Force Officers Pay Rules/ Regulations 2017. DA will be

admissible as per rates announced from time to time. Revised MSP @ Rs.

15500/- and DA thereon will also be admissible w.e.f. 1-1-2016.

ILLUSTRATION - 2

2.

Initial pay fixation in revised scales of a re-employed officer who has

retired post implementation of 7th CPC and was granted re-employment

post 01 Jan 2016. Example of a Colonel retired on 31 Mar 2016 and

re-employed on 01 Apr 2016.

(a) Col Retd on 31 Mar 2016

| (i) | Pay in Defence Pay Matrix | Rs 165400/- |

| (ii) MSP | Rs 15500/- |

| Total | Rs 180900/- |

(b) Revised Pension - 90450

(c) Fixation of Pay on date of Re-employment as on 01 Apr

2016

| (i) | Pay | Rs 165400/- |

| (ii) | Less Pension - Ignorable limit (90450 - 15000)

| Rs 75450/- |

| (iii) | Net Pay admissible | Rs 89950/- |

(d)

As the pay has been fixed based on the revised pay rules/regulations,

the re-employed officer will be entitled for annual increment as per the

existing provisions of Army/Navy/Air Force Officers Pay

Rules/Regulations 2017. DA will be admissible as per rates announced

from time to time. Revised MSP @ Rs.15500/- and DA thereon will also be

admissible w.e.f. 1-1-2016.