Minutes of the meeting with all CPPCs / Govt Divisions SBI on 10.01.2020

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF EXPENDITURE

CENTRAL PENSION ACCOUNTING

OFFICE

TRIKOOT-II, BHIKAJI CAMA PLACE,

NEW DELHI-110066

CPAO/IT &Tech/Master data/14 (Vol-III)/2018-19/176

21 .01.2020

Minutes of the Meeting

Kindly find enclosed the Minutes of the Meeting held on 10.01.2020 at 10:00 AM at Conference Hall of Central

Pension Accounting Office (CPAO) with all Heads of

CPPCs

/Government Business Divisions of State Bank of India to review the implementation of 7th CPC pension

revision and to discuss other issues under the Chairmanship or Chief Controller (Pension) for information and

further necessary action.

Sr. Accounts Officer (IT & Tech)

Minutes of the meeting held on 10.01.2020 with all the Heads of CPPCs/ Government Business Divisions

of State Bank of India (SBI) to discuss various issues.

Also check:

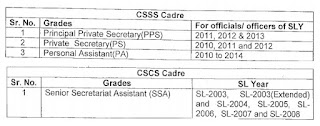

Revised Rotational Transfer Policy

applicable to CSS officers – Latest DoPT Orders 2020

A Meeting was held on 10.01.2020 under the Chairmanship of Chief Controller (Pensions) with the

representatives of CPPCs of SBI to discuss the timely payment of revised pension and arrears under

7th CPC and other pension related issues. At the

outset, Chief Controller (Pensions) welcomed all the participants and emphasized on the need of timely

payment of revised pension and arrears in the accounts of the pensioners by the CPPCs. Agenda items of the

meeting were discussed in detail and the following decisions were taken.

List of participants is attached at Annexure-I.

Agenda Item No. 1- Implementation of 7th CPC Pension Revision and its reporting by CPPCs

It has been observed from the reports as on 30th December, 2019 that there are delays in crediting the

revised pensions as well as arrears of pensions/family pensions by the CPPCs. As per the reports, there arc

many cases which are pending for more than 31 days. CPPC-wise details of the pending cases were handed over

to all the representatives. Most of the CPPCs reported that they had already revised and credited pension to

the pensioner / family pensioner accounts.

It was informed by the CPPCs that revision of pension cases are pending due to following reasons,

a) Discontinued PPO (more than 3 years.)

b) Non submission of life certificate.

Keeping in view of the above, it was decided that all the CPPCs would :

a) reconcile the scams of revised pension cases provided to them

b) prepare a list of discontinued PPOs and forward it to CPAO.

c) prepare a list of cases in which life certificate is pending along with details of the pensioners and

forward it to CPAO.

(Action : CPPCs )

Agenda Item No. 2 - Obtaining KYC from CPPCs for settlement of pending revision cases.

Most of the revisions pertaining to 7th CPC are already done. As per the records of

CPAO, 119690 revision of pension cases are still pending as

details of some pensioners are not available with either concerned PAO or I lead of Office.

Although KYC details were received from all the CPPCs of Sl:JI, All the CPPCs are req uested to furnish the

detail of the KYC detail as and when it is asked by the CPAO.

(Action : CPPCs )

Agenda Item No. 3 - IT related issue w.r.t e-Revision and fresh Pension cases

All the CPPCs of SBI were instructed to ensure forwarding the acknowledgement of e-SSA electronically to CPAO

at the earliest so that the difference between e-SA forwarded by the CPAO and e-SSA received by the CPPCs

could be nullified. CPPCs were also provided the formal for Acknowledgement. All the CPPCs were advised to

share their inputs with NIC, CPAO, if any problem is faced.

All the CPPCs were also instructed to acknowledge the receipt of SSA and Physical PPO booklet received by

them .

(Action: CPPCs / NIC CPAO)

- Development of e-PPO Booklet

CPAO is forwarding the e-PPOs received from PFMS to the CPPCs along with physical PPO booklets for making

necessary changes in their system. However, the manual PPO booklet is deemed sacrosanct for making payment.

It was also intimated in the meeting that physical PPO booklet will be discontinued soon.

All the CPPCs were again requested to make necessary changes in their software accordingly and comments, if

any, may please be submitted to CPAO.

(Action: CPPCs)

Agenda Item No.4- Compliace of Internal Audit observations on 7th CPC revisions.

It has been observed that clear and complete compliance reports arc not being submitted by the concerned

CPPCs .

All the CPPCs were requested to give full details in their compliance reports of the objection raised by

Internal Audit Wing so that the same could be verified and settled. All the CPPCs were also been asked to

improve and strengthen their internal control mechanism to avoid re-occurrence of the mistakes pointed out by

the Internal Audit Wing of CPAO.

The possibility of providing a utility lo upload the compliance report on the Bank’s login section of CPAOs

website will also be explored.

Internal Audit Wing was instructed to prepare an “Audit Manual” under the guidance of Technical Section,

CPAO.

(Action: CPPCs , NIC(CPAO), IAW (CPAO) and IT & Technical (CPAO))

Agenda Item No. 5 - Timely commencement of family pension, additional pension & restoration of commuted

portion of pension by CPPCs

It has been observed that family pension, additional pension and commuted portion of pension are not timely

commenced/restored. Since these issues are regularly discussed in the various meetings i.e. SCOVA Meeting,

High Level Meeting, Standing Committee Meeting, etc., all the CPPCs were advised to ensure timely

payments.

(Action: CPPCs )

Agenda Item No.6 - Timely submission of Life Certificates :

CPAO is responsible for the disbursement of death/disability pension under NPS Additional Relief. First time

identification of the pensioners is being done in the Bank branches based on the KYC details available with

the CPPCs where the pensioners / family pensioners have opened their pension accounts. CPAO starts the

pension payment based on the first time identification report received from CPPCs. These CPPCs branches are

also responsible for sending the life certificates of the pensioners / family pensioners to CPAO for the

continuation of pension to NPS-AR pensioners, in the month of November as CPAO is the disbursing

authority.

However, it is noticed that in many cases, despite submission of life certificates by the pensioners, bank

branches have not forwarded the same to CPAO. It has also come to notice of this office that some bank

branches are refusing to accept life certificate from NPS-AR pensioner for onward transmission to CPAO.

It was decided that CPAO will send the details of pending life certificates of NPS-AR pensioners to concerned

CPPCs with a request to instruct concerned branches to obtain and furnish the life certificate to CPAO in

time so that pensioners are not put under any financial hardship.

All the CPPCs were requested to accept life certificate both physically and digitally and promote “jeevan

Praman” among pensioners.

Further, CPPCs were once again informed that they should not make payment in NPS-AR cases.

(Action: CPPCs & NPS Section)

Agenda item No .7 - Return of Old PPO by the CPPCs .

Allotment of 12 digits PPO Number

It has been noticed from the CPAO data base that some pensioners are still drawing pension from the old alpha

numeric code. These alpha numeric data is reflected in the Payment scroll. CPPC-wise derails were provided to

the concerned CPPCs.

It was decided that all the CPPCs will send a scan copy of the PPO for allotment of 12 digit PPO Number.

Pension Payment Orders which are not in operation /inactive may be returned to CPAO for deletion from the

CPAO database. It is noticed from the database of CPAO that old PPOs which arc inactive arc not being

forwarded by the bank to the CPAO. CPPCs were advised to forward the same to CPAO al the earliest

(Action: CPPCs )

Agenda Item No.8- Submission of e-scrolls and Master Data

Reconciliation

It has been observed that there is slight improvement in submission of e-scrolls by CPPCs.

Details of pending scrolls were shared with the CPPCs and all the CPPCs were instructed to ensure that e-

scrolls are updated on a daily basis to CPAO after matching it thoroughly with the pension payments made. The

CPPCs should ensure that the date of scroll should be the date of transaction as appearing in the put through

statement issued by RBI. Furthermore, if any problem is faced by the CPPCs in uploading the e-scroll, they

may contact this office on email addresses mentioned below:-

kumardavinder [at] gmail.in

it [dot] support [dash] cpao[at]gov[dot]in

sraotech67 [at]

gmail.com

(Action: CPPCs and NIC)

- Master Data Reconciliation

Correct and reconciled master data maintained at CPPC level is a must for ensuring correct payment of pension

to the pensioners and avoid chances of excess/less/wrong payment of pension. However, many instances have

come to the notice of CPAO regarding less/over payment of pension leading to the grievances and court cases

by the pensioners. The reason for discrepancy in payment of pension is that CPPCs are not reconciling the

master data with the CPAO database regularly. There is inordinate delay in uploading of Master Data by some

CPPCs. Some CPPCs have not submitted their Master Data for last 2 years. For updating on Master Data at CPAO

level, whenever any value/data in the pension of a pensioner/family pensioner is changed, the same is

required to be reported by the bank through Format-F of e-Scroll However, it is noticed that CPPCs are not

providing the changed information to the CPAO.

All the CPPCs were instructed to upload Master Data for reconciliation and submit the changed information in

Format-F on “quarterly” basis. Furthermore, if any problem is faced by the CPPCs in uploading the master

data, they may contact this office on email addresses mentioned below:

kumardavinder [at] gmail.in

it[dot]support [dash] cpao[at]gov[dot]in

sraotech67 [at]

gmail.com

(Action: CPPCs and NIC)

Agenda Item No. 9-Discontinuation of BSR Code

At present, BSR code is being used in CPAO to identify bank branches. It has been observed in many cases that

Pensioners do not know BSR code of Pension Account Holding Branch and even many bank branches do not know

their BSR Code and often misunderstand it with branch code. IFSC is another uniq ue code which can be used to

identify individual bank branches and is known to both CPPCs and pensioners.RBI has also given its consent

for using IFSC instead of BSR code for identification of Bank Branches.

However, the IFSC from all the CPPCs of SBI have been received. All the CPPCs and GBDs of SBI are requested

to send the IFSC of the branches as and when it is asked by the CPAO.

(Action: CPPCs )

Agenda Item No.10- Handing over of SSA to the pensioners by CPPCs

All present, pensioner copy of SSA is being sent to the pensioners through post. References arc being

received by pensioners that they are not receiving their SSA copy due to following reasons.

- Some pensioners change their addresses after retirement.

- Some pensioners/family pensioners are illiterate and they are not well versed with technology to take

printout of their SSA from CPAOs website.

All the CPPCs agreed to provide a copy of SSA to the pensioner by the Pension Account Holding Branch on

request of the pensioner.

(Action: CPPCs)

Agenda Item No. 11-Pendency of Pensioners’ Grievances for more than 3 months through Web Responsive

Pensioners’ Service (WRPS)

It has been observed that many grievances are pending with CPPC, some of which are more than 30 days. CPPCs

informed that they had disposed some of the grievances but not updated them under WRPS module.

CPPCs were requested to ensure that all the grievances which are pending with them are disposed of within one

month and update the same on the WRPS portal so that pensioners are informed accordingly.

(Action: CPPCs / (NIC) CPAO /Grievance Cell)

Agenda Item No.12- Providing of Payment Details to all the Pensions

As per CPPC guidelines, CPPCs should provide account statement, TDS details, pension slip, the Due and Drawn

Statement in respect of each arrear and the Annual Income Statement to the pensioner.

CPPCs were requested to follow the CPPC guidelines and provide the pension slip, breakup of the pension and

arrear payments and other information as required to the pensioners.

(Action : CPPCs)

Agenda Item No. 13 - Issues pertaining to Defence Accounts, Deptt. of Telecommunication and Ministry of

Railways

Defence Accounts :

a. Acknowledgement of e-PPO by CPPCs

All the CPPCs were suggested lo develop a mechanism for acknowledgement of c· PPOs by CPPCs.

b. Delay in crediting of pension and family pension in the account of the pensioners.

It has been observed from the e scrolls received in the O/o PCDA that some of the CPPCs are crediting pension

and Family pension very late in the account of pensioner especially civilian pensioner. All the CPPCs were

handed the pendency list and were requested to improve their performance in crediting the pension/ family

pension on time.

c. To provide image of PPO for data purification

All the CPPCs were requested in the meeting to provide PPO image to them to facilitate data purification

which was agreed to.

d. Attend the meeting as and when it is convened by the PCDA.

All the CPPCs were requested to attend meetings as and when convened by the PCDA

Dept of telecommunication:

a) Recovery of excess and overpayment of pension

b) Return of inactive PPOs

c) Delay in Timely Payment of Pension and Family Pension

d) Reconciliation of Data

Ministry of Railways :-

a) Non-submission of E-scroll on time and Reconciliation thereof.

b) Acknowledgement of e-PPO

(Action: CPPCs)

Agenda Item No.14- Any other points with permission of chair

a) Payment of LTC to the pensioners of UT Chandigarh

The issue of payment of LTC to the pensioners of UT Chandjgarh was raised. The issue is being examined by the

Central Pension Accounting Office (CPAO).

The meeting ended with a vote of thanks to the chair.