7th Pay Commission: Transport Allowance not to be hiked

New Delhi: The Transport Allowance for central government employees will not be hiked and remain the same as 6th Pay Commission recommendations including Dearness Allowance(DA).

The Finance Ministry today informed about the report of the 'Committee on Allowances', headed by Finance Secretary Ashok Lavasa and said no hike in Transport Allowance (TPTA) for central government employees in its report. The committee accepted the 7th Pay Commission recommendation in this regard, which was announced earlier.

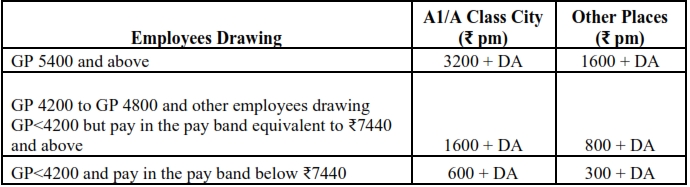

The Pay Commission has revised the Transport allowance (TPTA), which is given below:

The existing Transport allowance table for A1/A cities and other places is under:

The Pay Commission made report, assuming that the rate of Dearness Allowance 125 percent at the time of implementation of the pay commission recommendation, i.e. on January 1 next year.

Accordingly, the employees will not get any hike in Transport allowance on the time of implementation of the pay commission recommendation as the existing Transport allowance figure automatically reached the Pay Commission revised Transport allowance figure after adding 125 percent DA.

"In partial modification, the committee has further decided that the current HRA slab, which is 30 per cent of basic pay, for metros would continue," according to the sources.

However, the pay commission had recommended reducing the house rent allowance (HRA) to 24 per cent of basic pay as against the 30 per cent of basic pay employees were drawing under the Sixth Pay Commission.

The government has given higher basic pay with arrears, effective from January 1, 2016 in August 2016 to its employees on the recommendations of the 7th pay commission but referred hike in allowances to the Committee on Allowances.

Usually, once the recommendations of the pay commission are approved, the increase in basic pay is followed by an increase in allowances.

The hike in allowances, most probably to implement from the month of April and the Finance Minister Arun Jaitley may announce it after ending the model code of conduct on March 8.