7th CPC Revised Allowances should be from January 2016 -

NCJCM Staff side shares outcome of Standing Committee Meeting held on

3rd May, 2017

Shiva Gopal Mishra

Secretary

National Council (Staff Side)

Joint Council Machinery

for Central Government Employees

13-C, Ferozshah Road, New Delhi-110001

No.NC/JCM/2017

Dated: May 5, 2017

All Constituents of NC/JCM(Staff Side)

Dear Comrades!

Sub:

Proceedings

of the meeting of the Standing Committee meeting of the National

Council(JCM held on 03.05.2017 under the Chairmanship of Secretary

(DoP&T)

Immediately after Introductory Remark of the Secretary(DoP&T), the Staff Side raised the following issues:-

For

more than 7 years now the National Council(JCM) has not met.

Functioning of the JCM is completely diluted by the Government

Departments are also not holding meeting. The grievances on service

matter of the employees are getting accumulated. The JCM Machinery needs

to be strengthened and meeting with the Staff Side should take place

regularly.

2.It is now more than 10 months after proposed

"Indefinite Strike" was deferred by the Central Government Employees;

based on the assurance given by the Group of Ministers. None of the

demands is settled. "The Staff Side is in dark about the recommendations

of the Allowance Committee". "While Pay Commission's report is put on

the Public Domain after its submission to the government, why these

reports are kept secret", the Staff Side asked.Since Allowances

Committee report is considerably delayed the date of effect of the

revised allowances should be w.e.f. 01.01.2016.

The Staff Side

has demanded that, Minimum Wage should be raised, Pay Matrix should also

be revised, to recommend at least Minimum Guaranteed Pension of 50% of

the last pay drawn, Family Pension, and Disability Pension and GPF to

all the Central Government Employees. It is unfortunate that,

Option No.1, recommended by the 7th CPC for pre-01.01.2016 Pensioners,

is also rejected. The Central Government Employees are very much

agitated and there is going to be an uncontrollable unrest, hence the

Chairman is requested to convey our feelings to the government to avoid a

confrontation

(Chairman intervened and assured that he would convey the feelings of the Staff Side to the government).

In

spite of the Government orders many autonomous bodies have not revised

the pay scale of the employees as per 7th CPC and no order is yet issued

for revising the pension of the pensioners who retired from these

autonomous bodies. These issues needs to be settled by the government.

4.Staff

Side demanded to fill-up all the vacant posts and also to sanction

additional posts to man additional assets and additional workload

without insisting on Matching Saving.

Thereafter, Action Taken

Report on the progress/decisions taken on the Agenda Points discussed

during last Standing Committee Meeting was taken for discussion. Details

are given below-

DISCUSSION ON ACTION TAKEN REPORT

1.No privatization PPP or FDI in Railways and Defence Establishment

The issue will be separately discussed by the Railways and Defence Ministry with the Recognized Federations.

2. No Corporatization of Postal Services

Department of Post informed that there is no proposal of Corporatization / privatization at this juncture.

3.Scrap PFRDA Act and reintroduce the Defined Benefit Statutory Pension Scheme

The

Chairman stated that, we have to wait for the report of the NPS

Committee. However, the Staff Side insisted that, there should be at

least Guaranteed Minimum Pension of 50% of the last pay drawn, Family

Pension, and Disability Pension.

4.Regularize the existing

daily rated/casual and contract workers, and absorb trained

apprentices. No labour reforms should be carried out which are not in

the interest of workers.

After discussion it was decided

that, specific cases, if referred to the DoP&T by the Department/

Staff Side, may be considered. The issue of Gun and Shell Factory Casual

Employees would be considered in consultation with the MoD.

5.Revive

JCM functioning at all levels as an effective negotiating forum for

settlement of demands of the central government employees.

It was assured that JCM Machinery would be activated.

6.Remove the arbitrary ceiling on compassionate appointments.

The Staff Side demanded the following:-

- The arbitrary and artificial 5% ceiling may be removed.

- Pending the same the 5% vacancies should be calculated on the overall vacancies and not in the vacancies of the particular year.

- For calculation of vacancies Group B posts also should be taken into account.

- In

the Defence Ministry wards of service personnel are given Compassionate

Appointment in the 5% of Civilian Vacancies. However while calculating

5% vacancies, the vacancies of service personnel are not taken in to

account. This anomaly may be rectified.

- Defence Ministry has

proposed a onetime relaxation of 5% ceiling considering the large number

of pending applications. TheDoP&T has rejected the same. The issue

may be reconsidered by the DoP&T

After discussion on the above issues SecretaryDoP&T assured that he would reconsider the whole matter.

7.Ensuring Five Promotions in the Service Career

The

Staff Side insisted that MACP should be in the promotional hierarchy

and the condition of "Very Good" grading should be removed for granting

of MACP.

8.Non-implementation of the decision taken in the

46th National Council (JCM) Meeting held on 15th May 2010 with regard

to Item No. 20.

The Staff Side stated that in spite of

the DoP&T's direction not to recognize Associations of "Workers",

the Defence Ministry is not implementing the same. After discussion

Secretary DoP&T assured that he would discuss the matter with the

Defence Secretary and settle the same.

9.Reduction of one

day Productivity Linked Bonus (PLB) to the employees of OFB & DGQA

under Department of Defence Production against Cabinet decision and

Government orders.

Staff Side protested against the

arbitrary recovery of PLB days in the case of employees of Ordnance

Factories, DGQA, DGAQA and EME. After discussion Secretary DoP&T

directed the Department of Expenditure to reconsider the matter and if

necessary to put up the case to the Finance Minister for his

consideration.

10.Grant of one time relaxation to the

Central Government employees who have availed LTC-80 and travelled by

air by purchasing Ticket from other than authorized agent.

The

Staff Side insisted that the employees who are otherwise not eligible

for entitlement of air traveling, have purchased flight tickets from

other than authorized agents due to their ignorance of rule position

should not be punished by imposing recovery of the entire LTC amount

etc. Therefore to settle the matter once for all a onetime relaxation

may be given to such employees. After discussion it was decided that

DoP&T may reconsider the whole matter.

11.Grant of House Rent Allowance to the employees who have vacated government quarters.

The

Staff Side insisted that NAC should not be a pre condition for grant of

HRA to those employees who vacate the government quarters. After

discussion it was decided that the Directorate of Estate and Department

of Expenditure would consider the matter.

12.Restoration of interest-free advances withdrawn by the Government based on 7th CPC recommendations.

The Official Side assured that, the demand of the Staff Side would be conveyed to the government.

13.Grant of entry pay recommended by 6th CPC to the promotees under the provisions of CCS(RP) Rules- 2008.

The

Staff Side stated that the decision taken in the National Anomaly

Committee meeting in this regard was not accepted by the finance

ministry and at present the Principle Bench CAT New Delhi and the CAT

Madras Bench has given judgment in favour of the employees and hence the

Department of Expenditure may reconsider the matter. After discussion

it was decided that the Department of Expenditure would reconsider the

matter.

14.Grant of 3rd MACP in GP Rs.4600 to the Master

Craftsmen (MCM) of Defence Ministry who were holding the post of MCM in

the pre-revised pay scale of Rs.4500- 7000 as on 31/12/2005.

After

discussion it was decided that DoP&T will refer the matter to

Department of Expenditure recommending to reconsider their earlier

decision of rejection since the demand is in conformity with the rules

on ACP/MACP.

15.Carrying forward of Earned Leave by

Defence Industrial Employees on transfer/ appointment from non

Industrial to Industrial Establishment.

DOPT has agreed

with the demand and their decision would be conveyed to MOD after

receipt of the proposal from Defence Ministry in this regard.

16.Reimbursement of actual medical expenditure incurred by the employees in recognized hospitals.

CGHS rates are under revision and the same would be issued soon.

17.Dental Treatment in private hospitals recognized under CGHS / CS(MA) Rules, 1944 for CS(MA) beneficiaries.

CGHS

vide their OM dated 5th April 2017 has informed that the requirement of

no objection certificate has been dispensed with vide OM No.

S.14025/41/2015-MS dated 7.12.2016.

18.Removal of

ambiguity in fixation of pay of re-employed Ex-Servicemen and grant of

the same benefit extended to Commissioned officers to personnel below

officers rank also

The demand is under consideration ofDoP&T in consultation with the Department of Expenditure.

19.Permission

to opt for pay fixation in the revised pay structure on a date after

the date of issue of CCS(RP) rules 2016 notification (25.7.2016) in case

of employees whose promotion becomes due after 25.7.2006.

The issue is under consideration of Department of Expenditure and a decision would be taken soon.

20.Fill up all vacant posts including promotional posts in a time bound manner.

DOPT

is framing a fresh calendar for holding DPC and effecting promotions

which will enable to fill up the promotional Posts in a time bound

manner. Instructions will be issued very soon.

21.Abolish and upgrade all posts of Lower Division Clerks (LDCs) to Upper Division Clerks(UDCs)

The

Staff Side demanded that the LDC post may be merged with UDC and MTS

may be promoted directly to UDC. DoP&T agreed to consider the

demand.

Due to paucity of time, new agenda points, given by the

Staff Side, was not taken up for discussion. It was decided that the

Action Taken on the New Agenda Points would be communicated to the Staff

Side and a meeting would be thereafter convened to discuss these items.

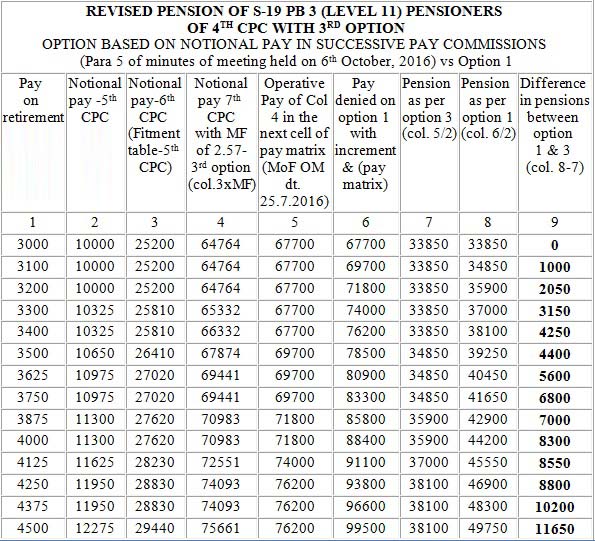

Cabinet approves revision of pension to pre 2016 pensioners

The

Cabinet approved modifications in the recommendations of the 7th CPC

relating to method of revision of pension of pre-2016 Pensioners and

Family Pensioners based on the suggestions made by the Committee,

chaired by Secretary(Pensions), constituted with the approval of the

Cabinet. While approving implementation of the 7th CPC recommendations

on 29th June, 2016, the Cabinet had approved the changed method of

pension revision recommended by the 7th CPC for pre-2016 pensioners,

comprising of two alternative formulations, subject to the feasibility

of the first formulation which was to be examined by the Committee. In

terms of the Cabinet decision, pensions of pre-2016 pensioners were

revised as per the second formulation multiplying existing pension by a

fitment factor of 2.57, though the pensioners were to be given the

option of choosing the more beneficial of the two formulations as per

the 7th CPC recommendations. In order to provide more beneficial option

to the pensioners, Cabinet has accepted the recommendations of the

Committee, which has suggested revision of pension based on the

information contained in the Pension Payment Order (PPO) issued to every

pensioner. The modified formulation will be beneficial to more

pensioners than the first formulation recommended by the 7th CPC, which

was not found to be feasible to implement on account of non-availability

of records in a large number of cases and was also found to be prone to

several anomalies.

Sincerely Yours

Sd/-

(Shiv Gopal Mishra)

Secretary (Staff Side)

National Council (JCM)

Source :

NCJCM Staffside